This week’s new 52-week lows… (Dec 12-18)

There’s been quite a lot of stocks falling below their 52-week low which reflects the state of the market.

Here’s this week’s 52-week low stocks.

⚡ Energy

Advantage Oil & Gas Ltd (AAV-T) TSE

Bellatrix Exploration Ltd (BXE-T) TSE

Delphi Energy Corp (DEE-T) TSE

Peyton Exploration & Develop. (PEY-T) TSE

Vermilion Energy Inc (VET-T) TSE

Western Energy Services (WRG-T) TSE

Athabasca Oil Sands Corp (ATH-T) TSE

Black Diamond Group (BDI-T) TSE

Birchcliff Energy Ltd. (BIR-T) TSE

Baytex Energy Corp (BTE-T) TSE

Calfrac Well Services Ltd (CFW-T) TSE

Cardinal Energy Ltd (CJ-T) TSE

Chinook Energy Inc (CKE-T) TSE

Cequence Energy Ltd. (CQE-T) TSE

Essential Energy Services Ltd. (ESN-T) TSE

Fission Uranium Corp. (FCU-T) TSE

Freehold Royalties (FRU-T) TSE

Storm Resources Ltd. (SRX-T) TSE

STEP Energy Services (STEP-T) TSE

Trican Well Service Ltd. (TCW-T) TSE

Torc Oil & Gas Ltd (TOG-T) TSE

Tourmaline Oil Corp (TOU-T) TSE

Yangarra Resources (YGR-T) TSE

🛢 Basic Materials

Ascendant Resources Inc (ASND-T) TSE

Conifex Timber Inc (CFF-T) TSE

Golden Queen Mining Co. Ltd (GQM-T) TSE

Lucara Diamond Corp (LUC-T) TSE

Atac Resources Limited (ATC-X) TSXV

Integra Resources Corp (ITR-X) TSXV

Millrock Resources (MRO-X) TSXV

AltiusMinerals Corp (ALS-T) TSE

Balmoral Resources (BAR-T) TSE

Copper Mountain Mining (CMMC-T) TSE

Erdene Resource Development (ERD-T) TSE

Hardwoods Distribution (HDI-T) TSE

Sherritt International Corp. (S-T) TSE

🏛 Financials

Artis Real Estate Investment Trust (AX.UN-T) TSE

Bird Construction Income Fund (BDT-T) TSE

American Hotel Income Properties (HOT.UN-T) TSE

Industrial-Alliance Life Ins (IAG-T) TSE

Power Financial Corp (PWF-T) TSE

Slate Office REIT (SOT.UN-T) TSE

Hut 8 Mining Corp (HUT-X) TSXV

Inspira Financial Inc (LND-X) TSXV

PRO Real Estate Investment Trust (PRV.UN-X) TSXV

AGF Management (B)(AGF.B-T) TSE

Canadian Imperial Bank of Commerce (CM-T) TSE

DREAM Unlimited Corp (DRM-T) TSE

IGM Financial Inc. (IGM-T) TSE

Mogo Finance Technology Inc. (MOGO-T) TSE

💹 ETF

Purpose Tactical Investment Grade Bond Fund ETF (BND-T) TSE

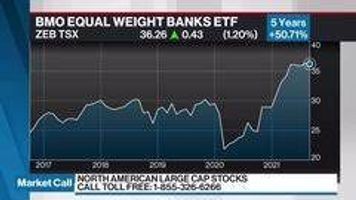

BMO Equal Weight US Banks ETF (ZBK-T) TSE

HBP Energy Bull+ E.T.F. (HEU-T) TSE

Harvest Energy Leaders Plus Income ETF (HPF-T) TSE

Horizons BetaPro S&P 500 Bull + ETF (HSU-T) TSE

First Asset Energy Giants Cov Call ETF Hgd (NXF-T) TSE

iUnits S&P/TSX Capped Energy ETF (XEG-T) TSE

iShares MSCI EAFE (CAD-Hedged) ETF (XIN-T) TSE

iUnits S&P/TSX Completion Index Fund (XMD-T) TSE

iShares Russell 2000(CAD-Hedged) (XSU-T) TSE

BMO Junior Oil Index ETF (ZJO-T) TSE

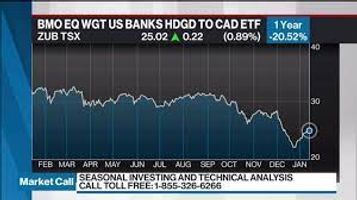

BMO Equal Weight US Banks Hedged to CAD ETF (ZUB-T) TSE

🛍 Consumer

Alcanna (CLIQ-T) TSE

BRP INC (DOO-T) TSE

Brick Brewing Company Ltd. (BRB-T) TSE

Dorel Industries (DII.B-T) TSE

Stingray Digital Group Inc. (RAY.A-T) TSE

💻 Technology

Maxar Technologies (MAXR-T) TSE

👨⚕️ Healthcare

Kalytera Therapeutics (KALY-X) TSXV

Cipher Pharmeuticals (CPH-T) TSE

Prometic Life Sciences Inc. (PLI-T) TSE

🚚 Industrials

Transcontinental Inc. (A) (TCL.A-T) TSE

💡 Utilities

Crius Energy Trust (KWH.UN-T) TSE

Use this list wisely to identify buying opportunities.

Happy trading !!!