This week’s new 52-week lows… (Dec 05-11)

This week there are still many resources stocks in the 52-week low zone including Petrus Resources which is on our own watch list.

Many ETFs are in their 52-week low too which reflects the state of the market.

Dollarama (set to launch its e-commerce effort tomorrow) can’t seem to stop going lower and lower and makes the list again this week.

Some notable growth stocks including Spin Master and Richelieu Hardware might be attractive at their current low price.

Here’s the full list :

💻 Technology

Spectra7 Microsystems Inc (SEV-T) TSE

Bewhere Holdings Inc (BEW-X) TSXV

Lite Access Technologies (LTE-X) TSXV

Vogogo Inc (VGO-CN) TSXV

Computer Modelling Group Ltd (CMG-T) TSE

⚡ Energy

Black Diamond Group (BDI-T) TSE

Calfrac Well Servicies Ltd (CFW-T) TSE

Delphi Energy Corp (DEE-T) TSE

Petrus Resources Ltd (PRQ-T) TSE

Torc Oil & Gas Ltd (TOG-T) TSE

Western Energy Services (WRG-T) TSE

Bellatrix Exploration Ltd (BXE-T) TSE

Canadian Energy Services & Technology (CEU-T) TSE

Essential Energy Services Ltd (ESN-T) TSE

Hyduke Energy Services (HYD-T) TSE

Nuvista Energy Ltd (NVA-T) TSE

Peyto Exploration & Develop (PEY-T) TSE

Paramount Resources (POU-T) TSE

PrairieSky Royalty (PSK-T) TSE

Parex Resources Inc (PXT-T) TSE

Secure Energy Services (SES-T) TSE

STEP Energy Services (STEP-T) TSE

Trican Well Services Ltd (TCW-T) TSE

Tourmaline Oil Corp (TOU-T) TSE

Tamarack Valley Energy (TVE-T) TSE

Seven Generations Energy Ltd (VII-T) TSE

Whitecap Resources (WCP-T) TSE

Blackbird Energy Inc (BBI-X) TSXV

🛢 Basic Materials

Chemtrade Logisitics Inc (CHE.UN-T) TSE

Camino Minerals Corp (COR-X) TSXV

Energold Drilling Corp (EGD-X) TSXV

Goldsource Mines Inc (GXS-X) TSXV

Medgold Resources Corp (MED-X) TSXV

Sirios Resources inc (SOI-X) TSXV

Avino Silver & Gold Mines Ltd (ASM-T) TSE

Balmoral Resources (BAR-T) TSE

Copper Mountain Mining (CMMC-T) TSE

Globex Mining Enterprises Inc (GMX-T) TSE

Hardwoods Distribution (HDI-T) TSE

Lucara Diamond Corp (LUC-T) TSE

Source Energy Services Ltd (SHLE-T) TSE

Atac Resources Limited (ATC-X) TSXV

Integra Resources Corp (ITR-X) TSXV

Romios Gold Resources Inc (RG-X) TSXV

Scorpio Gold Corp (SGN-X) TSXV

West Kirkland Mining Inc (WKM-X) TSXV

🛍 Consumer

Dorel Industries (DII.B-T) TSE

BRP INC (DOO-T) TSE

Stingray Digital Group Inc (RAY.A-T) TSE

Richelieu Hardware (RCH-T) TSE

Le Chateau Inc (A)(CTU-X) TSXV

EEStor Corp (ESU-X) TSXV

Greenspace Brands Inc (JTR-X) TSXV

Spot Coffee (SPP-X) TSXV

Ag Growth International Inc (AFN-T) TSXV

Alcanna (CLIQ-T) TSE

Canwel Building Materials Ltd (CWX-T) TSE

💹 ETF

First Asset US & Canada LifeCo Income Fund (FLI-T) TSE

iShares Core MSCI EAFE IMI Index ETF (CAD-Hedged)(XFH-T) TSE

iShares S&P/TSX Preferred ETF (CPD-T) TSE

HBP Energy Bull+ E.T.F. (HEU-T) TSE

Horizons Active Preferred Share ETF (HPR-T) TSE

iShares MSCI EAFE (CAD-Hedged) ETF (XIN-T) TSE

iShares S&P/TSX N.A. Preferred (XPF-T) TSE

BMO MSCI EAFE Hedged TO CAD (ZDM-T) TSE

BMO Equal Weight Bank ETF (ZEB-T) TSE

BMO S&P/TSX Laddered Preferred (ZPR-T) TSE

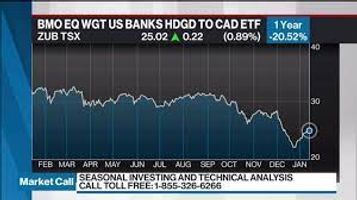

BMO Equal Weight US Banks Hedged to CAD ETF (ZUB-T) TSE

BMO Europe High Dividend Covered Call Hedged to CAD ET (ZWE-T) TSE

🏛 Financials

Life & Banc Split Corp (LBS-T) TSE

Sun Life Financial Inc (SLF-T) TSE

Canadian Imperial Bank of Commerce (CM-T) TSE

Canadian Western Bank (CWB-T) TSE

Gluskin Sheff and Associates (GS-T) TSE

Power Financials Corp (PWF-T) TSE

Slate Office REIT (SOT.UN-T) TSE

True North Commercial REIT (TNT.UN-T) TSE

Hut 8 Mining Corp (HUT-X) TSXV

PRO Real Estate Investment Trust (PRV.UN-X) TSXV

🚚 Industrials

New Flyer Industries Inc (NFI-T) TSE

Rocky Mountain Dealerships (RME-T) TSE

Grande West Transportation Group (BUS-X) TSXV

Chorus Aviation Inc (CHR-T) TSE

👨⚕️ Healthcare

Inmed Pharmaceuticals (IN-T) TSE

Microbix Biosystems (MBX-T) TSE

Kalytera Therapeutics (KALY-X) TSXV

Delta 9 Cannabis Inc (NINE-X) TSXV

💡 Utilities

Crius Energy Trust (KWH.UN-T) TSE

What 52-week low stock looks attractive to you?

Use this list wisely to identify buying opportunities.

Happy trading !