23 Stock Top Picks and 7 ETF (Nov 30 Dec 6)

This week there were 23 Top Picks and 7 ETF in a wide range of industries: Technology, ETF, Financials, Healthcare, Industrials, Consumer and Energy.

Here are this week’s Top Picks as selected by: David Cockfield, Steven Ko, Paul Macdonald, Stephen Takacsy, John Hood, Brian Madden, Lorne Steinberg, Joshua Varghese, Stan Wong and Cameron Hurst

💻 Technology

💹 ETF

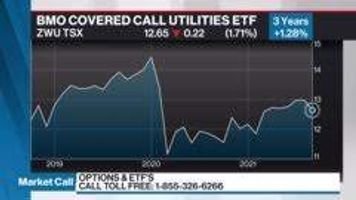

BMO Covereld Call Utilities ETF (ZWU-T)

iShares DEX Floating Rate ETF (XFR-T)

Vanguard US Dividend Appreciation Index ETF (VGG-T)

SPDR Consumer Staples ETF (XLP-N)

The Real Estate Select Sector SPDR Fund (XLRE-US)

SPDR Health Care E.T.F. (XLV-N)

🏛 Financials

Invesco QQQ Trust, Series 1 (QQQ-US)

Alexandria Real Estate Equities (ARE-N)

👨⚕️ Healthcare

Bausch Health Companies Inc (BHC-T)

UnitedHealth Group Inc (UNH-N)

Koninklijke Philips Electronics (PHG-N)

🚚 Industrials

New Flyer Industries Inc (NFI-T)

🛍 Consumer

Alimentation Couche-Tard (B)(ATD.B-T)

⚡ Energy