This week’s new 52-week highs and lows … (Jan 30-Feb 5)

The markets are trudging on as usual, and lots of companies are hitting their 52-week high. Couche-Tard, which didn’t see a drop in their price back in December during the sell-off, is once again coming out on top. Not to be beat by Metro, this week it’s Loblaw’s hitting their high. Some basic material and energy companies aren’t doing as well, hitting their 52-week low.

Here’s this week’s 52-week high and low list for securities listed on Stockchase.

Here’s this week’s 52-week highs stocks …..

🚚 Industrials

Thomson Reuters Corp (TRI-T) TSE

DIRTT Environmental Solutions (DRT-T) TSE

👨⚕️ Healthcare

AEterna Zentaris Inc. (AEZS-T) TSE

Sienna Senor Living Inc (SIA-T) TSE

💡 Utilities

Algonquin Power & Utilities Corp (AQN-T) TSE

Northland Power Inc (NPI-T) TSE

🛍 Consumer

Alimentation Couche-Tard (B) (ATD.B-T) TSE

Empire Company (A) (EMP.A-T) TSE

Goodfood Market Corp. (FOOD-T) TSE

Loblaw Companies Ltd (L-T) TSE

⚡ Energy

Cameco Corporation (CCO-T) TSE

Enbridge (ENB-T) TSE

Pembina Pipeline Corp (PPL-T) TSE

🏛 Financials

Choice Properties REIT (CHP.UN-T) TSE

Allied Properties REIT (AP.UN-T) TSE

First Capital Realty (FCR-T) TSE

H&R Real Estate Inv Trust (HR.UN-T) TSE

RioCan Real Estate Investment (REI.UN-T) TSE

Summit Real Estate Investment (SMU.UN-T) TSE

💻 Technology

Sangoma Technologies Corp. (STC-X) TSXV

Absolute Software Corp. (ABT-T) TSE

🛢Basic Materials

Labrador Iron Ore Royalty (LIF-T) TSE

Sandstorm Gold Ltd. (SSL-T) TSE

Golden Valley Mines (GZZ-X) TSXV

Pure Gold Mining Inc. (PGM-X) TSXV

Dundee Precious Metals Inc. (DPM-T) TSE

Sandstorm Gold Ltd. (SSL-T) TSE

💹 ETF

Purpose High Interest Savings (PSA-T) TSE

iShares DEX Floating Rate ETF (XFR-T) TSE

iShares S&P/TSX Capped REIT (XRE-T) TSE

iShares S&P/TSX Cap. Utilities (XUT-T) TSE

BMO Low Volatility Cdn Eqty ETF (ZLB-T) TSE

BMO Equal Weight Utilities Index ETF (ZUT-T) TSE

iShares Premium Money Market E.T.F. (CMR-T) TSE

HAP Floating Rate Bond ETF (HFR-T) TSE

iShares Short Term Strategic Fixed Income ETF (XSI-T) TSE

BMO Floating Rate Hi Yield ETF (ZFH-T) TSE

BMO Equal Weight REITs Index (ZRE-T) TSE

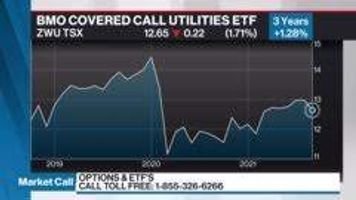

BMO Covered Call Utilities ETF (ZWU-T) TSE

📱 Telecommunications

Quebecor Inc (B) (QBR.B-T) TSE

BCE Inc. (BCE-T) TSE

Shaw Communication (B) (SJR.B-T) TSE

Here’s this week’s 52-week low stocks ….

⚡ Energy

Crescent Point Energy Corp (CPG-T) TSE

Pipestone Energy Corp. (PIPE-X) TSXV

International Frontier Resources (IFR-X) TSXV

Chinook Energy Inc (CKE-T) TSE

🛍 Consumer

Westport Fuel Systems Inc (WPRT-T) TSE

🛢Basic Materials

InZinc Mining Ltd. (IZN-X) TSXV

Ecobalt Solutions Inc. (ECS-T) TSE

Rusoro Mining Ltd (RML-X) TSXV

💹 ETF

HBP NYMEX Nat’l Gas Bull+ (HNU-T) TSE

HBP Global Gold Bear+ E.T.F. (HGD-T) TSE

💻 Technology

Use this list wisely to identify buying opportunities.

Happy trading !!!