7 Essential Tips and Tools to Succeed as a Canadian DIY Investor

It has never been easier to be a DIY investor.

With multiple new Fintech tools available each year, all sorts of model portfolios (Couch Potato Portfolios, Growth Portfolios, Income Portfolios, Etc.), low fee online brokerage, free ETFs (Exchange Traded Funds) purchases and even All-in-One ETFs, many resources ease the DIY investor’s life.

Still, do-it-yourself investing is not for everyone. It requires time, money, a willingness to learn and dedication to succeed.

The Key to DIY Investing Success

- The Top 7 DIY investing essentials

- Define your asset allocation and risk profile

- Trade with discipline

- How to invest in stocks in Canada?

- What stocks should I buy?

- Top 7 Canadian stocks & ETF model portfolios

- Top 7 resources for picking stocks

- Rule #1 … and 72 more

- 72 rules for winning in the market

- When to sell stocks? When to buy stocks?

- Learn from the experts

- Establish your own stock rating system

- Trading tools to run your DIY investing strategy

- Wealthica : your consolidated investment dashboard

- How does Wealthica works?

- Passiv : automated rebalancing

- More guidance and help picking stocks or ETFs

- Don’t let emotions get in the way

- Stay committed to your DIY investing plan

Affiliate Disclaimer – Even though we receive referral fees from companies mentioned on this website, we try to make our posts and tips unbiased and backed by our own experience and social proof. If you sign up for 5i Research or Questrade using our affiliate link we may earn a commission. We will use most of the revenues to make Stockchase and Wealthica better. Your support helps and we genuinely appreciate it. If you don’t want to use it, here’s a non-affiliate link to Questrade. Either way we truly believe 5i Research is an invaluable tool for DIY investors and that Questrade is the best brokerage available in Canada, you’ll be happy with them. Do your research on Google, Reddit and Facebook groups and you’ll find most people say the same.

We have a lot more than 7 Tips and Tools to share with you.

We will start with the Top 7 DIY Investing Essentials, later we will share the Top 7 Canadian Stock & ETF Model Portfolios and also the Top 7 Resources for Picking Stocks. We even have the 72 rules for Winning in the Market.

Oops, it’s not 7, but there’s a 7 in 72. 🍀

I’m sure you will build your own list of 7 essential tips from the hundreds of tips we’ll share in this post. Why not do it and share it? Once you are done reading the whole post, use the comments to share your own top 7 from our tips. 🗣

The Top 7 DIY Investing Essentials 🤑

- You need discipline

- You need time and desire to learn

- You need an asset allocation plan

- You need a brokerage account that enables automation

- You need some guidance and help picking stocks

- You need to stick to your plan and track your progress

- You need to prevent emotions getting in the way

We made some money when Novacap sold iWeb to Internap a few years ago.

That’s when we started being interested in everything related to investments. We started investing. Tried a wide-range of brokerages and wealth management services. Later founded Wealthica because we wanted to track all our investments in one place. And then, we acquired Stockchase to dig further into stocks and the market in general.

Some of us made some good moves, like buying Apple Stocks in 2011. 💸

We all made some bad moves, like working with an advisor that bought a bunch of resource, oil and mining stocks which Bestselling Author and growth investor Robin R. Speziale calls Capital Destroyers in Capital Compounders (get the Paperback and eBook versions free when you signup for Stockchase Premium).

We also have some epic fails, like investing a significative amount in Sensio Technologies, a Canadian 3D TV maker that went bankrupt in 2016. 💣

We learned in the process.

Today we stay away from resources, oil and mining stocks. We don’t fall in love with stocks. And we sell stocks that we wouldn’t buy today. It’s better to realize a -30% loss vs waiting until it falls to a big zero. We wouldn’t call ourselves stock experts, but we comfortable saying we are successful DIY investors.

Today our DIY investing portfolios usually beat the market.

We’ll tell you how we do it.

And we’ll tell you about 7 tools we use to do it better.

Define your Asset Allocation and Risk Profile

Most investors focus on stock selection and look at the upside of a stock, but in reality, asset allocation plays every bit as big a role if you look at long-term returns. Asset allocation is not something that should be static, but is something that investors should pay attention to and focus on.

The first step before starting your DIY investing journey is to decide on your risk tolerance. Your risk profile will establish the split between equities and bonds in your portfolio. Deciding on your asset allocation is mostly up to answering one question: What’s your tolerance for volatility?

How much should you set to equity and bonds in a portfolio? The old rule of thumb is to set your bond percentage the same as your age.

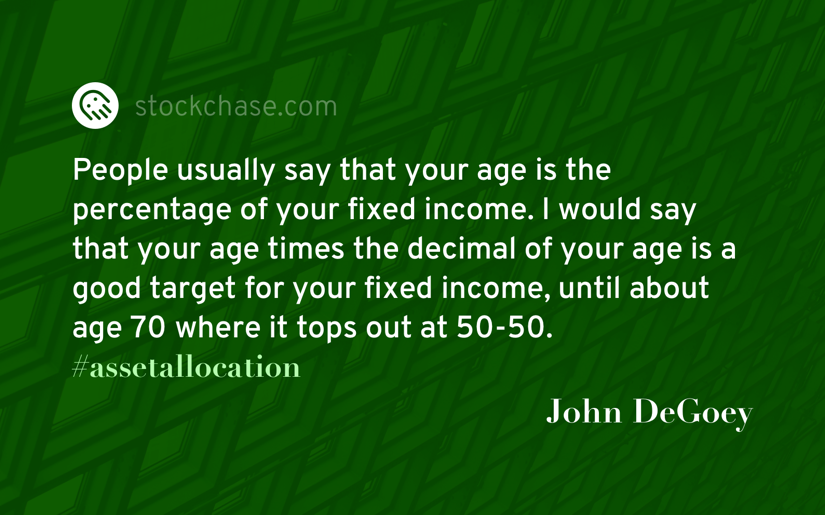

John Degoey on Stockchase came up with a new version of the old rule:

My asset allocation between fixed income and equity is an old rule of thumb with a new world wrinkle. People usually say that your age is the percentage of your fixed income. I would say that your age times the decimal of your age is a good target for your fixed income, until about age 70 where it tops out at 50-50. For example, if you are 50 years of age, 50X.50 = 25%, so 25% of your investments in fixed income. 60 years of age is 60X.6 = 36% in fixed income. By the time you are 71 years of age, when you have to convert your RRSP to a RIF, that is when you get to 50-50. The reason for this is that we are all living much longer.

Investopedia agrees it may be time to revisit the asset allocation rule.

Whatever the rule you choose to follow, remember that this is just a starting point. The idea is to reduce your risk over time. Adapt it to your own situation, your tolerance to risk and your lifestyle.

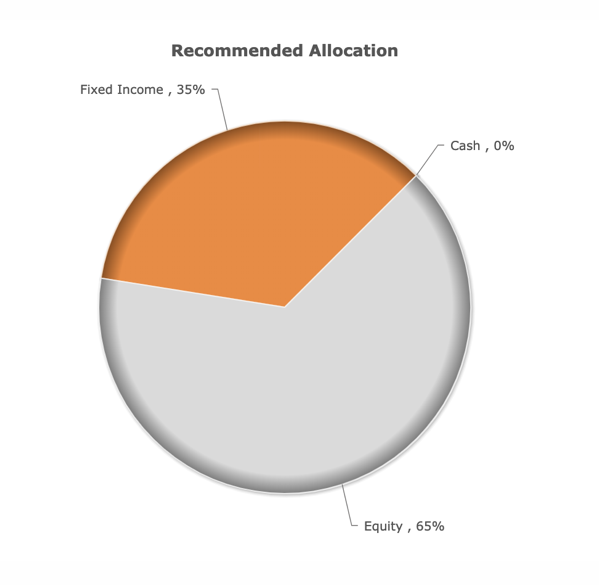

You probably already have an idea of your ideal asset allocation and the age rule might do it for you. But if you don’t, try CalcXML’s Asset Allocation Wizard. It’s a quick 10 questions wizard that will generate an asset allocation chart according to your answers.

I don’t like volatility that much. My own asset allocation is about 40% fixed income and 60% stocks. It might not be optimal in term of returns but at least I’m not going to freak out next time the market is down 20%.

Here’s my wizard result :

Your asset allocation defines how you will balance risk versus possible upside.

You need to adjust each asset in your portfolio according to your risk tolerance and goals. This can help you decide if a 80/20 All-in-One ETF would work for you or build your ideal ETF Couch Potato Portfolio.

Once you have decided on your asset allocation, you can go a step further and divide split your equity allocation into Canadian and International stocks or ETFs. Another step further, you would split it between Large Cap, Small/Mid Cap and International. The Canadian Couch Potato Model Portfolios divides the equity allocation between a Canadian Index ETF and an International Equity ETF.

There are no perfect plans, only perfect intentions.

George Patton said “A good plan, violently executed now is better than a perfect plan tomorrow.” Don’t wait for the perfect plan. Start today. Set your plan, execute and stick to it.. You can always refine your strategy along the way.

Trade with Discipline

You have to have a rule-based investment philosophy to allow long-term success. You should think of your profits, not in terms of the relationship with a cost of your investment, but just in absolute terms. It’s your money. It doesn’t have any less value because you’ve earned it in the market. You have to always be looking at the company in terms of how it is trading today relative to its past, and what might happen in the future. You have to judge a company every day, ask yourself if it is something you would buy today. You shouldn’t just be holding on because it is “winning”.

How to invest in stocks in Canada?

Now that you defined your asset allocation and know your risk profile, it’s a good time to start thinking about opening a brokerage account and picking stocks.

How to invest in stocks in Canada

- Save some money (at least $1000)

- Open a brokerage account (read our review of the Best Canadian Brokerage)

- Pick stocks or ETFs and start trading

It’s surprisingly simple to start investing in stocks.

You’re on your own to get the money but once you have at least $1000 ready to invest then you’ll find plenty of resources to help with the Canadian Brokerage and the Picking Stocks and ETFs parts. One of the easiest ways to start would be Canadian Couch Potato Investing. Save money and open a brokerage account, you’ll learn the rest along the way.

What stocks should I buy?

Now that’s a real challenge.

While buying stocks is simple, picking the right stocks is hard. As a starting point before you start picking stocks or ETFs, you should Signup for Stockchase and read the free . It will help set your stock picking process.

I like to pick Canadian and U.S. growth stocks. I do my homework and study the companies before I buy. I try to follow most of the 72 Rules for Winning in the Market and incorporate it into my personal investing strategy. I don’t rely on my own stock picking for 100% of my portfolio, I also invest in some model portfolios for diversification.

I like this quote from Warren Buffet…

When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients. Both large and small investors should stick with low-cost index funds.

If you’d like to follow Buffet’s advise, you should have a look at ETF Model Portfolios…

Top 7 Canadian Stocks & ETF Model Portfolios

- Model ETF Portfolios @ Canadian Couch Potato

- Dividend Stocks Portfolio @ Dividend Earner

- Balance, Income and Growth Portfolios @ 5i Research

- Dividend Portfolio @ Tawcan

- Canadian Dividend Stocks Portfolio @ Finance Journey

- Model ETF Portfolios @ Canadian Portfolio Manager

- Model ETF Portfolios @ PWL Capital

If you’re all in for picking stocks and building your own portfolio…

Risk comes from not knowing what you’re doing.

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

The 21st century will witness further gains, almost certain to be substantial. The goal of the non-professional should not be to pick winners — neither he nor his ‘helpers’ can do that — but should rather be to own a cross-section of businesses that in aggregate are bound to do well.

By periodically investing in an index fund, for example, the know-nothing investor can actually outperform most investment professionals.

Here are our top 7 resources for picking stocks…

Top 7 Resources for Picking Stocks

- Latest Top Picks @ Stockchase

- Top Stock Experts Top Picks Portfolios @ Stockchase Premium

- 72 Rules for Winning in the Market

- Capital Compounders by Robin R. Speziale (Free with Stockchase Premium)

- Tradingview Stock Screener

- Simply Wall Street

- Explore Growth ETFs Holdings at ETFdb

If you prefer going the other way around and choose ETFs that hold specific stocks you like, you can find ETFs holding a specific stock using ETF.com. For example, to get a list of all ETFs that hold the Apple Stock you would load https://www.etf.com/stock/AAPL in your browser. You can replace AAPL for the stock symbol of your choice and ETF.com will report on all ETFs holding this particular stock.

Rule #1 … and 72 more

There are only two rules of investing. Rule No. 1: Don’t lose money. And Rule No. 2: Don’t forget Rule No. 1.

That’s according to Warren Buffet. 👍

It’s a great rule, but maybe you’d like some more guidelines. Robin R. Speziale has 72 rules for picking stocks to win in the market.

72 rules for winning in the market

- Hold 24-40 core stocks

- Don’t let any stock grow larger than 10%

- Don’t invest in price-takers

- Look for price and volume growth

- I like companies that expand globally

- Look for a competitive advantage

- Cost cutting isn’t a business strategy

- Invest in wealth recipients

- I don’t rely on Return on Equity (ROE)

- No negative net income nor EPS

- I focus on small-cap and mid-cap

- Invest more when market declines

- Managing a portfolio is like gardening

- More…

The 72 rules is an engaging quick read that will benefit all do-it-yourself investors for sure. For the budding investor, Robin’s 72 Rules will hopefully be valuable information to help you get started in the stock market. And for the experienced investor, maybe there’s something new that you didn’t think about before, or at least Robin’s rules validate how you’re already investing in the market.

Here’s what some real readers say about Robin’s books :

It’s a quick read. You can probably go over the 72 rules in less than 1 hour.

For me, it was really insightful.

When to sell stocks? When to buy stocks?

Buy low and sell high. That’s what they say.

Easier said than done.

I really like this tip from Mad Money with Jim Cramer and I feel it’s one of the most important tips for DIY investors to get the best price for a stock :

Jim Cramer advises to never buy or sell a stock all at once.

This is a real important one: never buy a stock all at once, I can’t stress it enough: do not, under any circumstances, buy all at once.

Using partial buys or partial sells you try to get the best price over time.

As we wrote before, establish your own rules and stick to the process religiously. Jason Del Vicario’s selling rule is to have two prices for when to sell a stock :

I have two prices for when to sell a stock. I sell 50% on the first tranche and 100% on the second. I select it visually – no algorithm. My portfolios are concentrated so I need to be disciplined. I stick to the process religiously. This has helped me avoid massive drawdowns.

You can’t know for sure if it’s the right time to buy or sell a stock.

It’s impossible to time the market. BUT, if you establish your own buying or selling process and study the companies you invest in to acquire some knowledge of the fair value of a stock you invest in then you surely will be ahead of the others that don’t.

Learn from the experts

Experienced investors start with an edge, but you can catch up quickly by learning from the experts and start winning in the market too.

As a DIY investor, you can find answers on many Canadian investment forums like Canadian Money Forum, RedFlagDeals Investing, Personal Finance Canada or Canadian Investor on Reddit. You can also follow many stock experts on Twitter or join Investing Facebook groups.

You have too many questions? 🧐

- What % should I allocate to an individual sector?

- What % should I give an individual holding?

- How many stocks should my portfolio hold?

- Should I invest more when market declines?

- Should I focus on large caps? Small caps? Mid caps?

- And many more…

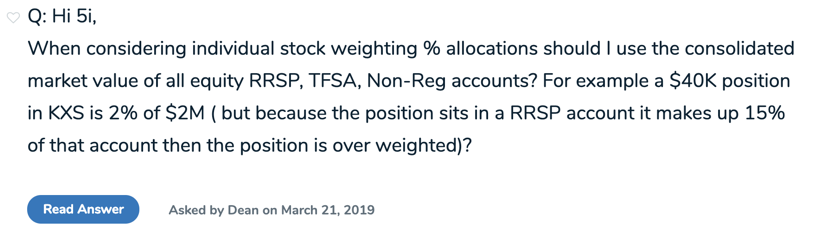

If forums are not your thing and you’d like to have the opinion of a real stock expert, you can always Ask Peter Hodson (you can ask 1 question free during the free trial when you sign up with the Stockchase coupon code).

Peter Hodson is a frequent guest on BNN Market Call and all his stock opinions and top picks and be found on his profile page on Stockchase. He founded 5i Research a conflict-free Canadian investment research service specifically to provide DIY investors some guidance.

He can answer all your investment questions.

Signup for the free trial to read the answer to this question and 75,000 more.

Establish your own stock rating system

There are advantages for a “do-it-yourself” investors to get to know a company and understand what it’s doing.

That takes a lot of time but if you know what you own, you can better tolerate the volatility, have a better return potential and stick to your plan without reacting too quick during market volatility.

Trading tools to run your DIY investing strategy

Some tools can make it easier for you to execute your plan.

Robo-advisors can streamline your investing experience but they charge fees and they do nothing you can’t replicate with your brokerage account, free ETFs purchases and model portfolios. We noted it earlier, DIY investing takes time. If you don’t have the time, going with robo-advisors might be a good alternative.

Choose your brokerage wisely. Not all Canadian Brokerages are created equal.

As we note in our Questrade Review: Pros & Cons of Trading with Questrade Canada (2019), one thing that makes Questrade stand out from other brokerages from traditional financial institutions is it’s App Hub and Third-Party API.

Using Questrade’s App Hub and Third Party API you can connect your brokerage accounts with tens of third-party applications. Our preferred apps, the ones we use, within the App Hub are Wealthica and Passiv.

You have to connect with third-party apps to unleash the power of Questrade’s API. Automation is one of the best kept secrets of successful DIY investors. It’s something that’s available to all DIY investors using our preferred apps : Questrade, Wealthica and Getpassiv.

Wealthica

One of the reasons Questrade is our favorite brokerage is because we can use the API to connect our brokerage account securely with third party APIs like Wealthica (the team behind Wealthica is the same that brings you Stockchase).

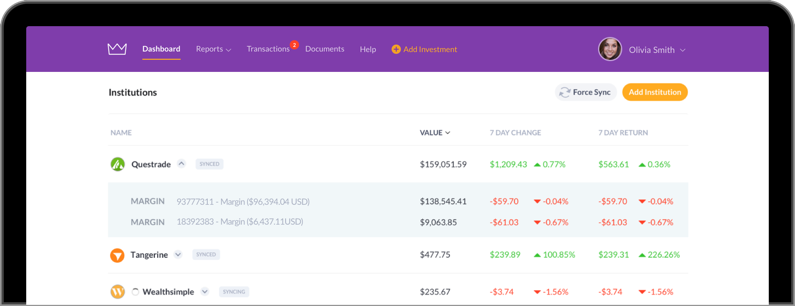

Once connected with your Questrade account, Wealthica automatically syncs your transactions and holdings and presents you with a full net worth dashboard you can use daily to monitor your investments and your asset allocation.

If you have investments at other financial institutions or other brokerage, Wealthica also supports connecting with over 60 Canadian financial institutions but only 5 of them (including Questrade) offer an API. You’ll have to use your credentials to connect with the others (that’s why we prefer Questrade).

How does Wealthica works?

Wealthica is the Canadian version of Personal Capital (very popular in the US).

It consolidates investments from different financial institution on a cloud-based platform. It works by connecting to your financial institutions, synching all your transactions data and then showing you all your investments in a single dashboard.

Wealthica will also give you access to income, gains and other investments reports. It comes very handy when tax time comes. You can use Wealthica to calculate your capital gains easily.

Wealthica is a must-have tool in your DIY investing arsenal, it’s free and it works with most Canadian investing accounts. Sign up at Wealthica.com

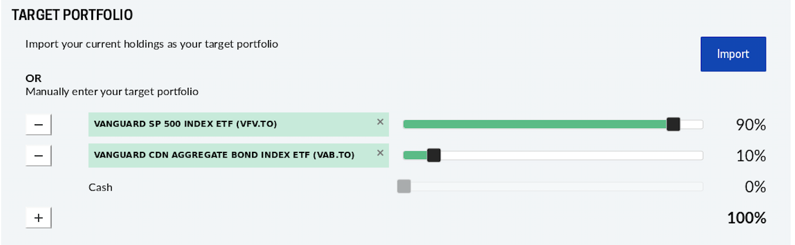

Passiv

Passiv make it easy for you to stick to your plan, manage your portfolio and rebalance your investments in order to enforce your asset allocation goals. If you followed our guidelines to define your asset allocation and chosen the stocks or ETFs you want to invest in, then Passiv is the tool you need to put your portfolio on autopilot.

You can save time by letting Passiv calculate & execute the trades needed to keep your portfolio balanced according to your chosen asset allocation.

With Questrade, Wealthica and Getpassiv in your DIY investor toolkit, you will surely save precious time and raise your chances of success in making your investments work for you. And this is all possible thanks to Questrade’s App Hub.

Guidance and help picking stocks or ETFs

Too many Canadian holds too much Canadian equity and zero American. Also, don’t fiddle with your portfolio. Let it ride and leave it alone during volatility.

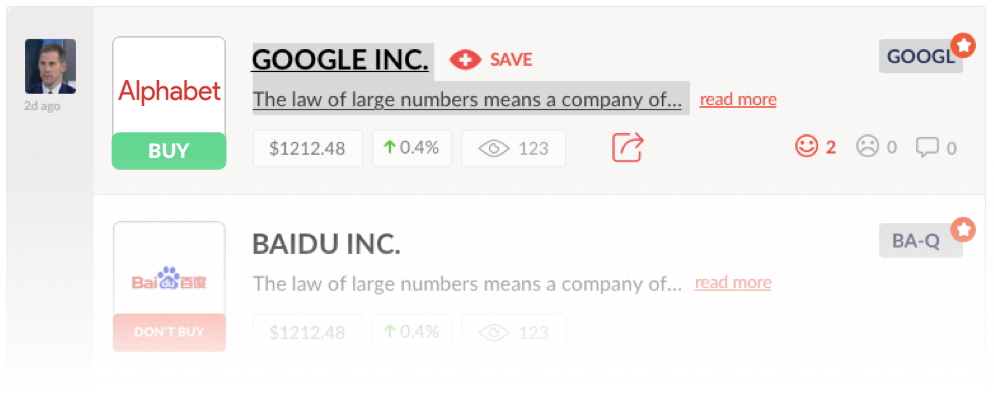

For daily stock opinions and stock experts comments you got to give Stockchase a try. Read our post about How to Pick stocks using Stockchase.

On the main Stockchase pages we publish daily stock expert opinions. We also have a free newsletter to receive the expert’s top picks daily straight to your inbox. Signup for Stockchase Daily for new stock ideas each day.

Reading experts comments on Stockchase and having access to 5i Research to ask my own questions give me a lot of confidence to manage my investments myself.

If you already like Stockchase, you can look at upgrading to Premium. We also have a free 1 month 5i Research trial offer with 1 free question credit! Just use Stockchase as the offer code, signup and ask your first question free. You’ll get an answer to your question, no credit card required and no catch. If you like the service, you can sign up for the yearly subscription.

Redeem your free trial and free question credit to ask your own question now !

Don’t let emotions get in the way

The main problem with most DIY investors and their portfolios is emotion.

Stock experts say emotions corrupt a DIY portfolio and promote themselves as the objective; detached investment professional that can call the shots. When you’ve got your online brokerage account, automation tools and 5i Research as your on-demand financial advisor, as a DIY investor you will be the one calling the shots.

You’ll need discipline and concentration to prevent emotions from getting in the way.

Investors should not chase the latest and greatest at whatever valuation; be less emotional and think about holding it for 5-10 years.

Stay committed

Finally, to achieve long-term DIY investing success, you must stay focused on your plan through good markets and bad. You won’t have an advisor to comfort you, but you’ll be reading what the experts are saying, asking questions to the team at 5i Research and using automation tools to make sure you stay on course.

Don’t forget to make regular contributions to your investment accounts, reinvest dividends and focus on compounding.

Happy investing!

What is your favourite tip or tool for DIY investors?