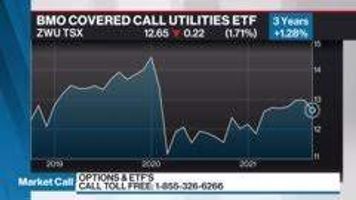

John Hood BMO Covered Call Utilities ETF

ZWU-T

BUY

Jun 29, 2023

BMO Covered Call Utilities ETF

ZWU-T

BUY

Jun 29, 2023

Stock price when the opinion was issued

You might be interested:

Remember that a GIC and dividend stock have different levels of risk. Consider preferred shares and covered call ETFs like ZWC which gives broad exposure to Canadian dividends with a covered call overlay. ZWU, too, which is an alternative to fixed income, but gives equity market risk.

In the area of the market that's quite stable, mainly because utilities are regulated by government. They do become interest-rate sensitive. Recently got caught up in the AI hype and all the power that will be needed, so got a bit ahead of themselves. Low beta. About as safe as it gets in the stock market.

When the sector outperforms, that's a warning signal. And we've had a couple of those days. Great place to hide, good yield, getting the covered writing premiums. Challenge is that because utilities are so low volatility, that premium is less.

ZWU holds Canadian utilities, writes covered calls on ~50% of the portfolio. Use it if you have a neutral or range-bound view of the Canadian utilities market. If you buy near market bottom, won't participate as much in the snap-back.

If you see growth and capital appreciation on the horizon, use ZUT -- almost the same basket, but with no covered call overlay. Lower yield. Money works for you over the long haul.

This is an accounting item. There are 2 types of ROC, 1 good and 1 bad. The bad one is where the ETF provider is goosing up the return to be seen to be giving you more of a yield, but they end of giving you some of your own money back. That's not good. BMO doesn't do that.

To find out which one it is, you can call the ETF provider. Here's another way. Look at the underlying holdings. For example, assume they pay a dividend of 4%, there's an MER for the fund, and the option overlay generates a return of 2-3% a year. If you're being paid 6-7%, it's all good and you're getting it all. But if you're being paid 6%, but none of the underlying holdings pay 6% and there's no covered call overlay, then you're getting some of your own money back

Not sure why in this particular case, but it could be because the premiums from the covered calls were not as good. Or it could be that the prices of some of these utilities have gone up.

You buy this for yield. Utilities are very susceptible to changes in yield. They pay high yields, but it can come back and bite you. This is a pretty solid performer, and the covered calls give a really good boost. He's very much in favour of covered calls.