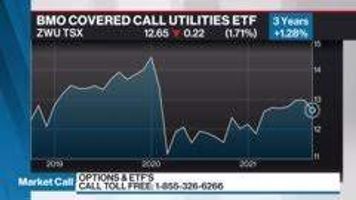

Stan Wong BMO Covered Call Utilities ETF

ZWU-T

DON'T BUY

Feb 14, 2023

BMO Covered Call Utilities ETF

ZWU-T

DON'T BUY

Feb 14, 2023

Stock price when the opinion was issued

You might be interested:

In the area of the market that's quite stable, mainly because utilities are regulated by government. They do become interest-rate sensitive. Recently got caught up in the AI hype and all the power that will be needed, so got a bit ahead of themselves. Low beta. About as safe as it gets in the stock market.

When the sector outperforms, that's a warning signal. And we've had a couple of those days. Great place to hide, good yield, getting the covered writing premiums. Challenge is that because utilities are so low volatility, that premium is less.

ZWU holds Canadian utilities, writes covered calls on ~50% of the portfolio. Use it if you have a neutral or range-bound view of the Canadian utilities market. If you buy near market bottom, won't participate as much in the snap-back.

If you see growth and capital appreciation on the horizon, use ZUT -- almost the same basket, but with no covered call overlay. Lower yield. Money works for you over the long haul.

This is an accounting item. There are 2 types of ROC, 1 good and 1 bad. The bad one is where the ETF provider is goosing up the return to be seen to be giving you more of a yield, but they end of giving you some of your own money back. That's not good. BMO doesn't do that.

To find out which one it is, you can call the ETF provider. Here's another way. Look at the underlying holdings. For example, assume they pay a dividend of 4%, there's an MER for the fund, and the option overlay generates a return of 2-3% a year. If you're being paid 6-7%, it's all good and you're getting it all. But if you're being paid 6%, but none of the underlying holdings pay 6% and there's no covered call overlay, then you're getting some of your own money back

He always advocates diversifying a portfolio. You don't want to have too much in one name. Ever. He doesn't know the percentage of the investor's portfolio. If BCE is only 1% of the portfolio and with BCE being relatively cheap, he'd stick with it. But if BCE is a huge part of the portfolio, then diversifying that risk away would make sense.

Here's the challenge: what's in XDV? Banks, lifecos, energy names. Has done well in recent years, whereas BCE has underperformed dramatically.

For more diversification, he'd look at ZWU -- gives you some telcos and utilities plus a covered call. Still some exposure to BCE, but diversified within the utilities space and given you an enhanced yield. Nice, tax-efficient yield north of 7%. And you don't have the current extremes of the banks and lifecos of XDV.

Holds pipelines and telcos, plus an overlay of 8.3% dividend. Lots of cash flow, but utilities won't be the best performer if the economy grows. For income, this is great, but not the best for a total return. Covered calls aren't good in rising markets.