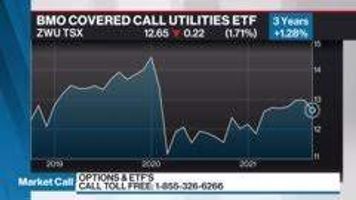

Daniel Straus BMO Covered Call Utilities ETF

ZWU-T

WEAK BUY

Aug 21, 2024

BMO Covered Call Utilities ETF

ZWU-T

WEAK BUY

Aug 21, 2024

Stock price when the opinion was issued

You might be interested:

This is an accounting item. There are 2 types of ROC, 1 good and 1 bad. The bad one is where the ETF provider is goosing up the return to be seen to be giving you more of a yield, but they end of giving you some of your own money back. That's not good. BMO doesn't do that.

To find out which one it is, you can call the ETF provider. Here's another way. Look at the underlying holdings. For example, assume they pay a dividend of 4%, there's an MER for the fund, and the option overlay generates a return of 2-3% a year. If you're being paid 6-7%, it's all good and you're getting it all. But if you're being paid 6%, but none of the underlying holdings pay 6% and there's no covered call overlay, then you're getting some of your own money back

He always advocates diversifying a portfolio. You don't want to have too much in one name. Ever. He doesn't know the percentage of the investor's portfolio. If BCE is only 1% of the portfolio and with BCE being relatively cheap, he'd stick with it. But if BCE is a huge part of the portfolio, then diversifying that risk away would make sense.

Here's the challenge: what's in XDV? Banks, lifecos, energy names. Has done well in recent years, whereas BCE has underperformed dramatically.

For more diversification, he'd look at ZWU -- gives you some telcos and utilities plus a covered call. Still some exposure to BCE, but diversified within the utilities space and given you an enhanced yield. Nice, tax-efficient yield north of 7%. And you don't have the current extremes of the banks and lifecos of XDV.

Depends on your asset allocation, risk tolerance, and whether the GIC is in a registered account or not. He likes the BMO lineup for ETFs a lot. With lower interest rates and the thirst for data centres, thinks there's more to go in the utility space.

He himself writes covered calls on stocks. So he doesn't like ETFs that, as a mandate, have to write covered calls. It looks enticing, but the miracle of stocks is the growth you get from not selling calls or only selling them selectively as a tool.

Going all in on any one sector is a bit extreme. If we get into higher-than-expected inflation, utilities will struggle. Defensive tilt, and sells calls to enhance income. Low volatility sector means call-writing premium also lower. Fine choice for part of a diversified portfolio.

For covered call strategies, always consider the yield and the source of that yield. With this one, you'll forego some upside if utilities markets are strong, but you get more yield on an ongoing basis. Best for ongoing yield to pay your bills.

Compare it to a non-covered call alternative such as ZUT. Over the long term, outperforms the covered call on a total return basis. The better growth alternative.

Given the kind of market we're heading into, some strategists feel pretty good about utilities. Utilities are considered defensive, as people need to pay them whether the economy is good or bad; tend to have stable dividends.