Larry Berman CFA, CMT, CTA BMO Short-Term US TIPS Index ETF

ZTIP-T

DON'T BUY

Mar 03, 2025

BMO Short-Term US TIPS Index ETF

ZTIP-T

DON'T BUY

Mar 03, 2025

$34.150

Stock price when the opinion was issued

E.T.F.'s

It's the ideal tool to help you make quicker, more informed decisions for

managing and tracking your investments.

You might be interested:

TOP PICK

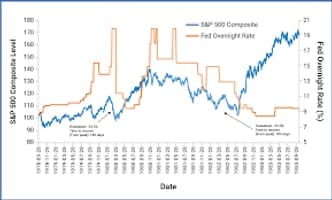

These are treasury inflationary linked bonds and therefore real return bonds. They are for 0 to 5 year terms. With short term bonds the rate of return increases as inflation increases. Google resolve, inflation and volatility for a more in depth analysis by his team. Inflation and poor global growth are coming.

Problem with inflation-indexed bonds is that when inflation is expected to go up, they can perform really well if inflation does actually go up. But if the market anticipates inflation rising, and it doesn't, these bonds perform horribly.

The average investor shouldn't touch them. Leave them to the professionals.