John DeGoey iShares MSCI Edge Min Vol EAFE

EFAV-N

COMMENT

Jun 08, 2017

iShares MSCI Edge Min Vol EAFE

EFAV-N

COMMENT

Jun 08, 2017

Stock price when the opinion was issued

You might be interested:

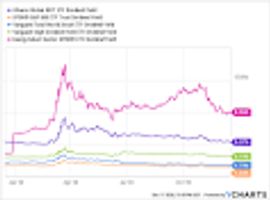

There are better opportunities now in Europe and Japan. This gives you a broader exposure across Europe of all the countries, with a little bit less on the UK. Also, there is a better mix in terms of stability in the sectors. In the last 3 years, there has been significant outperformance on this ETF, but last year underperformance. Good dividend yield.

(A Top Pick April 20/17, Up 11%) Gets access to European and Japanese markets that he's been adding to. Has lower volatility, choosing stocks with a lower beta. It underperformed the overall EAFE index, but still a good area to be in. Promising changes in Japan with huge increase of women in the workforce and increasing immigration to fill jobs. Europe just had its highest PMI.

This is investing in continental Europe, and on a minimum volatility basis. The product has done reasonably well in the recent past. Continental Europe is a good diversifier. If you want to have equity exposure and you want to get out of Canada, and are a relatively nervous investor, this is probably a good way to do it.