Top 5 World and Emerging Market ETFs You Should Buy Now

This post was first written in July 2018 and was refreshed with updated data in March 2019.

Emerging Market ETFs rebound coming?

With all the tariffs noise and a stronger US dollar, now might be a good time to buy emerging markets ETFs to benefit from the rebound when Trump’s trade war threats are over. Just a few days ago, The New York Times reported that the United States and China were pushing for a late April meeting to complete a trade deal.

When you invest in Emerging Markets you invest in countries like China, Japan, Taiwan, Korea and many more where you bet the growth will be in the future.

We’ve selected 5 ETFs stock experts suggest you add to your portfolio…

Top Emerging Market ETFs

Goldman Sachs Emerging Market Equity ETF (GEM-N)

GEM-N was a top pick on Stockchase more than 1 year ago and was still a buy in December 2018. It is currently trading a bit under its 52-week high and has recovered from its drop at the end of 2018.

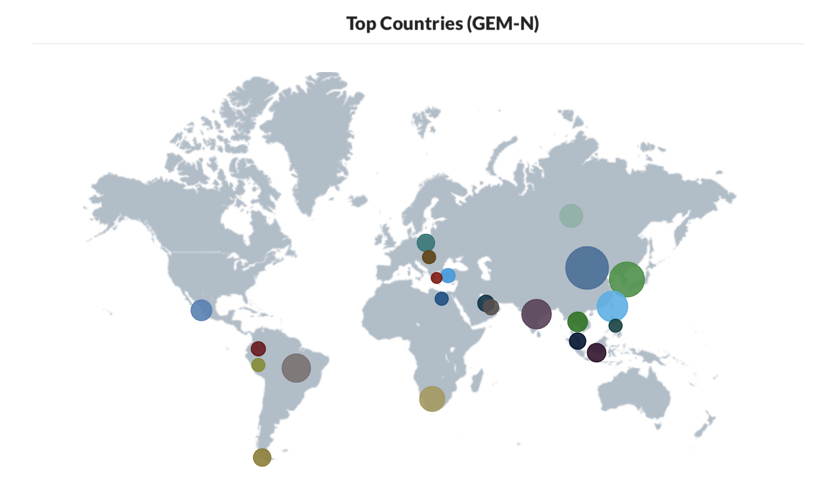

According to Goldman Sachs’ GEM-N ETF Facts, around 30% of the holdings in GEM-N are from China. 70%+ are Asian stocks with some exposure to Europe, Middle East, Africa and Latin America.

Read all the experts’ opinions on Stockchase :

If you missed buying into them earlier, now is a good time given all the tariffs and the strong U.S. dollar. Last year, the MSCI was double the valuation of the U.S. market, and today it is half. You can see a 18% growth rate.

iShares Core MSCI Emerging Markets (XEC-T)

XEC-T has been selected 3 times as a Top Pick in 2018 and as of March 2019 it had already been selected 2 more times as a Top Pick.

Last time was just a few days ago on March 7th 2019.

This ETF gives you long-term access to the growth potential of emerging markets. With this ETF, you own over 1500 worldwide stocks.

Most of the exposure is to China, Korea and Taiwan.

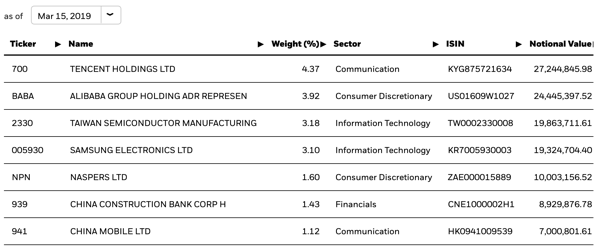

The top holdings include Tencent, Alibaba, Samsung and China Mobile.

Read all the experts’ opinions on Stockchase…

EM used to be resource-oriented from South America. It’s now an Asia ex-Japan index, dominated by IT and by China, Korea, and Taiwan with names like Tencent and Alibaba. Costs only 25 basis points. EM bore the brunt of Trump’s screaming, but will bounce back when this is over.

Vanguard FTSE Global All Cap ex Canada (VXC-T)

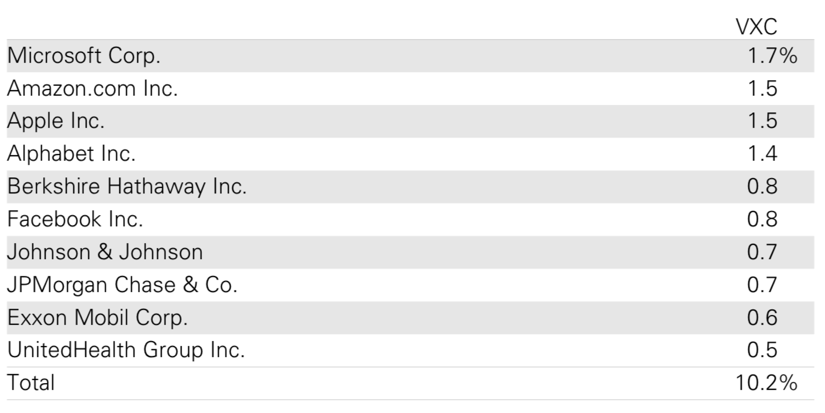

VXC-T is mostly US stocks (55.9%) with a focus on developed and emerging markets excluding Canada. Top holdings of Vanguard’s VXC include Microsoft, Amazon and Apple. It might be interesting if you’re not already into US stocks.

Read all the experts’ opinions on Stockchase…

If you missed the diversification last year by not getting out of Canada, this is a good time to start. If you have a 100% Canadian portfolio, and would like 20% to be in something else, this is a great way to get your toe into the water.

BMO MSCI EAFE (ZEA-T)

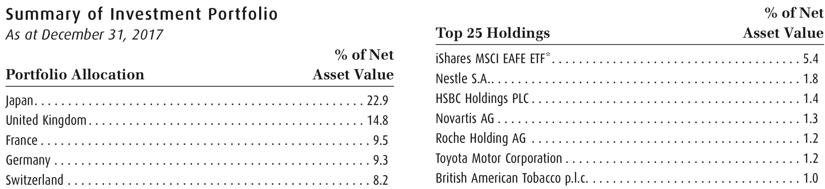

ZEA-T is like the S&P 500 but for stocks outside the US.

It has 22.9% Japan exposure.

As of the end of 2017 it did not hold any Chinese stocks which makes it an interesting option if you’d like to invest in emerging markets excluding China.

Read all the experts’ opinions on Stockchase…

Your portfolio is going to be made up of fixed income and equities, and he recommends that within the equity portfolio that you have 1/3 of your equity positions invested in international markets. That is a big order, and if you need to start somewhere, this is the one he is using (ZEA). A great entry point into the international market.

Vanguard FTSE Emerging Markets All Cap (VEE-T)

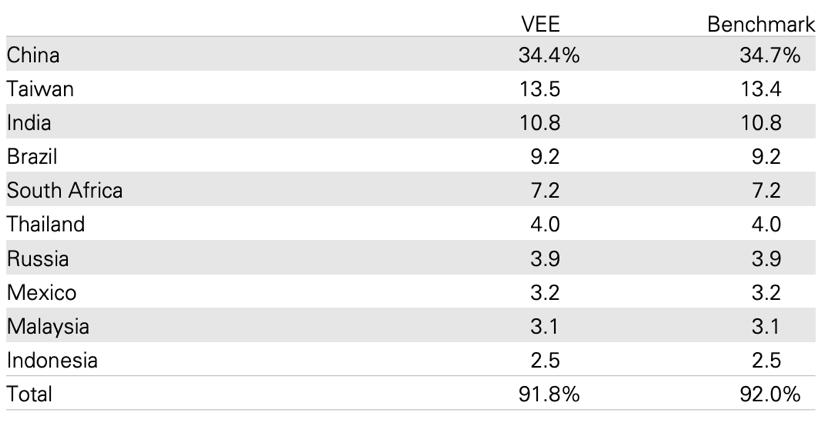

VEE-T is mostly China (34.4%) with holdings like Alibaba and Tencent. It also has some exposure to Taiwan, India, Brazil and South Africa.

Read all the experts’ opinions on Stockchase…

An area that he watched for a long time and finally decided to invest in. Growth in these countries is going to be higher than in Canada. 34% China, 14% India.

Happy trading!

Do you know other great emerging market ETFs? Tell us in the comments.