Jim Cramer - Mad Money Kyndryl Holdings

KD-N

WAIT

Dec 08, 2021

Kyndryl Holdings

KD-N

WAIT

Dec 08, 2021

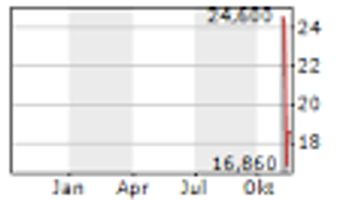

Stock price when the opinion was issued

You might be interested:

KD has done well year-to-date, up nearly 60%. Revenues are still declining but its recent quarter had improved cash from operations and positive free cash flows. The company has also had positive adjusted EPS for two quarters now and beat estimates for the recent quarter. KD also authorized a $300M buyback yesterday which gave the stock a further bump. We are seeing some improvement here and while it is not a cheap turnaround opportunity at 20x forward earnings, this could be a decent time for interested investors to start stepping in.

Unlock Premium - Try 5i Free

IT services. Modernizes mission-critical systems for some of the world's companies such as MFC, BNS, SLF, BCE, MSFT, Government of Canada. Some really big investors got into the name early.

Company says it's going into a very profitable period. He's modelling earnings growth of 116% from 2025-27, trades at 23x. Really nice growth and under the radar. Huge addressable market. An AI beneficiary. No dividend.

Its growth means you probably want to own it in a non-registered account.