Stan Wong ProShares Equities for Rising Rates ETF

EQRR-Q

TOP PICK

Jan 12, 2022

ProShares Equities for Rising Rates ETF

EQRR-Q

TOP PICK

Jan 12, 2022

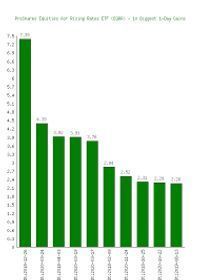

Unique ETF. Basket of US stocks that should outperform the S&P 500 during periods of rising interest rates. Large cap names that we all know. He sees the 10-year US treasury yield surpassing 2%, maybe even 2.25%, by the end of this year. Targets sectors that have the highest correlation to US 10-year yields, and the stocks that have the best tendencies to outperform as rates rise. In 2021, it outpaced the S&P by over 7%. Valuation discount to the S&P. Ticks boxes of financials, energy, and basic materials at 75% of the portfolio.

$54.840

Stock price when the opinion was issued

E.T.F.'s

It's the ideal tool to help you make quicker, more informed decisions for

managing and tracking your investments.

You might be interested:

HOLD

Designed to outperform the market during rising rates. Outpaced the S&P 500 by 30% over the last 2 years. Long-term bond yields will probably pause with a deceleration. 32% in energy, a long-term secular benefit. 26% in financials, which are cheap. 19% materials, a mixed bag. If you own it, hold. Yield is 3%.

HOLD

Stop loss level? Designed to outperform in rising rate environment. 56% is in US energy and financials, both of which he likes right now. Up 9% YTD relative to the S&P. He'd put a stop loss about 10-15% above the 200-day MA. From a fundamental perspective, he likes the sectors and will continue to hold.