Our Mega List of the Latest ETFs Mentioned on Stockchase

ETFs are great ways to have an easily diversified portfolio.

Often times, ETFs track an underlying index of a certain subsection of the market. An exchange-traded fund is a basket of securities that trade on the market. There are great ETFs options for all kind of investors, but how can one decide which ETF to buy? That’s where Stockchase comes handy.

Good performing ETFs

There are hundreds of ETFs mentioned on Stockchase. We built a mega list of the latest ETFs mentioned on Stockchase since September 2019. Mose of these ETFs have been chosen as Top Picks by stock analysts.

How to choose what ETF to invest in?

JustETF has a great post about how to make the right ETF selection.

Do you want to invest in Canadian equities? Emerging Markets? Renewable Energy? REITs? Dividends focussed ETFs? You should first decide what you want to invest in and then have a look at our ETF mega post and pick some ETFs matching your desired asset allocation.

If this sounds too complex for you, you should have a look at All-In-One ETFs.

The ETFs Mega Post

The list below is exhaustive, if you prefer to start with the most popular options you might want to read our post about the most popular ETFs for your portfolio. If you prefer to go deeper into a specific kind of ETFs, read our Country-Specific ETFs, Emerging Markets ETFs or World Markets ETFs posts.

ETFs Mega List

Here’s our ETF mega list…

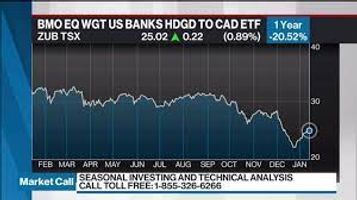

BMO Equal Weight US Banks Hedged to CAD ETF (ZUB-T)

An ETF of American banks. It was recently named a top pick by Keith Richards.

Harvest Equal Weight Global Utilities Income ETF (HUTL-T)

An income ETF that has holdings from outside of Canada, though there are some Canadian companies within the fund.

iShares MSCI Emerging Markets (XEC-T)

An ETF that follows a broad index in emerging markets. There are stocks from South Korea, Japan, Philippines and India amongst others.

BMO Low Volatility Cdn Eqty ETF (ZLB-T)

A low beta ETF that is a good place to park cash. Mostly banks and utilities with virtually no energy stocks.

iShares Cdn Univer. Maple ETF (XSH-T)

A mostly bank paper ETF. A great place to park your money for short-term. Yield is around 2.8% that is paid monthly.

Purpose Behavioural Opportunities Fund (BHAV-T)

An ETF that takes advantage of trading errors made by investors and overreactions by the market. A fund based on behavioural economics.

SmartBe Global Value Momentum Trend Index ETF (SBEA-NEO)

Another fund that is based on behavioural economics. This ETF covers stocks as well as bonds. A trend following fund that is good for reducing equity exposure in case there is a downturn.

BMO Ultra Short-Term Bond ETF (ZST.L-T)

A short-term cash product that is good for income. They reinvest the proceeds and is a slow and steady climber.

US Vegan Climate ETF (VEGN-Q)

A new ETF this year. It replicates the S&P 500 index without companies that are involved with animal testing, cruelty or fossil-fuels.

VanEck Vectors Low-Carbon Energy ETF (SMOG-N)

A green technology ETF. Tesla is one of their largest holdings. This fund includes LED lights, cars, and other environmentally friendly tech companies.

Horizons Gold ETF (HUG-T)

A fund that holds gold itself. A good option to provide stability in a portfolio. It is future based.

Brompton European Dividend Growth (EDGF-T)

A fund that follows European dividend growers. Pays a 4.9% dividend. An actively managed ETF that is for income growth too.

Franklin LibertyQT U.S. Equity Index ETF (FLUS-T)

An ETF composed of trending value and momentum stocks. A very diversified fund with 250 holdings. Pays a 1.8% dividend. It is also considered recession proof.

iShares Edge MSCI Min Vol USA ETF (USMV-N)

A low volatility ETF that protects against geopolitical risks and downside. A collection of lower volatility US stocks.

Dynamic iShares Active U.S. Dividend ETF (DXU-T)

An actively managed ETF of US dividend paying companies. A bet on the rising of the US market. The funds holdings include Microsoft.

BMO Low Volatility US Equity ETF (ZLU-T)

The US version of ZLB. A defensive play that focuses on stocks with low beta. Made of utilities, consumer staples and discretionary.

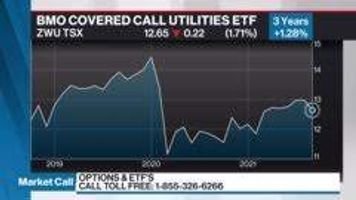

BMO Covered Call Utilities ETF (ZWU-T)

A utilities ETF with a great yield at over 6%. A good ETF to park your money for cash-flow. Very defensive.

iShare Core MSCI World ex Canada (XAW-T)

A global ETF that gives foreign exposure outside of North America. The top holdings include 57% in US and 8% in Japan. A good diversification tool.

iShares DJ Medical Devices E.T.F. (IHI-N)

An ETF that follows the medical device industry. Medical device companies have done very well.

Mrk Vectors Gold Miners ETF (GDX-N)

A hedge for gold. Seasonality for gold is from November to February. A real store of value in a low interest environment.

iShares DJ Home Construction ETF (ITB-N)

An ETF of home builders and building material companies. A bullish bet on the US housing market. Seasonal strength is from October to February.

SPDR S&P Dividend ETF (SDY-N)

An index of S&P dividend paying stocks. It yields more than fixed income. Seasonality is coming and once it starts outperforming the market, it is time to buy.

Vanguard Growth ETF Portfolio (VGRO-T)

An ETF that is 80% stocks nad 20% bonds. A good way to start investing. There is some international exposure, though it is mainly US.

Vanguard U.S. Aggregate Bond Index ETF (VBU-T)

A play on the US bond market. It is hedged to the Canadian dollar to decrease currency risk. A 2.5% yield.

Vanguard FTSE Developed Europe Index (VE-T)

A European multinational equity ETF. Europe had a good quarter and money is coming back to Europe. A cheap way to play the space.

iShares Mortgage Plus ETF (REM-N)

The ETF does not hold physical properties but rather borrows short and lends back long into mortgage backed securities. A big yield of 8.9%.

iShares MSCI Europe Financial (EUFN-Q)

The ETF tracks financials in Europe which have been beaten down recently. Negative interest rates are also a headwind so the fund is cheap right now. There is good value and a move in fiscal policies will be a catalyst. 6% yield.

iShares MSCI SouthKorea E.T.F. (EWY-N)

A Sout Korea equities fund. South Korea has fallen out of favour due to the trade war, but it could bounce back with positive news on trade talks.

Horizons Equal Weight Canada Banks Index ETF (HEWB-T)

Follows the big 6 Canadian banks. There is no dividend, so you can defer capital gains. Seasonality begins in October.

iShares Barclays 20+ Yr Treas Bond (TLT-Q)

A long US treasuries play. The best asset class to protect your portfolio during an economic recession. Bond portfolio will do well when equities fall.

Franklin Liberty Canadian Investment Grade Corporate E (FLCI-T)

A medium risk corporate bonds ETF. Actively managed but with a low management fee. Good for income.

BMO Ultra Short-Term Bond (ZST-T)

A fund that buys bonds under 1-year maturity. You get the higher yield from when bonds had a higher coupon. You are earning yield to maturity with this ETF.

iUnits S&P/TSX Capped Energy ETF (XEG-T)

An energy ETF with oil company holdings. There were announcements of more pipelines being reconsidered. It looks like there is a major bottom forming and if you are bullish, it could be considered.

BMO US High Dividend Covered Call ETF (ZWH-T)

A covered call overlay ETF. If you believe the market will remain flat, you get good income from this. Yield around 6%.

BMO Covered Call Cdn Banks ETF (ZWB-T)

A good fund for income. Pays 5% dividend, with possible capital gains. If you think banks will fall or go sideways, this is a good way to play the space.

Vanguard Mega Cap Value Index Fund ETF (MGV-N)

An ETF that holds lots of financials and healthcare. Major holdings include Berkshire Hathaway, JPM and Exxon as well as 300 other securities. A play on value stocks.

iShares MSCI All Country World Minimum Volatility (XMW-T)

The underlying stocks are characterized by being less vulnerable to the economic cycle. A good long-term diversification play.

Horizons Global Risk Parity ETF (HRA-T)

A risk balanced portfolio that you can buy and forget. It owns true global diversification with a US dollar hedge.

iShares MSCI Brazil ETF (EWZ-N)

An ETF of Brazilian companies where PMI is growing. Not without volatility but there is promise in the economy.

ProShares Pet Care ETF (PAWZ-Q)

A new ETF this year that focuses on pet owners and their expenses. It holds pet pharmaceuticals, food and supply companies.