Are your penny-pinching ways keeping you from enjoying life?

Attention Baby Boomers: We’ve Updated this Post with New Content and More Ways to Enjoy Life Without Breaking the Bank 🕺

This is a guest post by Jim McKinley. Jim is a retired banker with almost 30 years of experience. He created MoneywithJim to share his advice and other resources on a variety of financial topics.

[adinserter block=”4″]

Good news!

There are ways you can live it up without getting out of control financially. Here are some inexpensive thoughts on kicking up your heels that balance your frugal habits with a little more fun and live the good life on a tight budget.

Free Up Some Cash

Even if you’re used to stretching your dollars, there may be some ways to eke more funds out of your budget. For instance, you may be able to save money by shopping around for new health care coverage. Finding a plan that is more affordable is a smart choice, as you may be paying for more coverage than you need. You also may be able to free up some funds by evaluating your mode of transportation.

Sometimes you can save money with a different car insurance company, car sharing, carpooling with friends or family members, or taking public transportation. In Montreal, Ottawa, Kingston and 6 more cities Communauto offers reservation-free car rentals for as low as 40¢/min. Think outside the box, maybe you can sell your car and use your money to enjoy life.

Did you think of getting rid of your landline? These days, people don’t bother that much with the landline. Get rid of your landline and get a good cell phone with an unlimited calling plan and enough data. I use a Fido Bring-Your-Own-Phone $50/month plan with 6GB of Data. In addition to 6GB of data per month, Fido gives you 5 x 1 hour of unlimited data per month. When you know you’ll be using a lot of data (videos) you can activate your free hour of data.

And of course, there are senior discounts.

Never hesitate to ask for a senior discount, as you may be pleasantly surprised at how many businesses offer you a break. Check around, because utility providers, hair salons, grocery stores, and travel providers are all known to offer a lower price to seniors. Even banks offer perks to seniors. TD offers monthly checking account fees discounts, National Bank offers a $3.95 account.

Fun Money!

Once you have some cash freed up and you’re committed to loosening your purse strings (at least a little!), there are plenty of great ways to spend your fun money:

- – Community sports events

- – Road trips

- – Pick fruit

- – Potlucks

- – Become a foodie

- – Community sports events

Let’s go into more details…

[adinserter block=”2″]

Road trips

Instead of the expense of a cruise or airline tickets, consider a driving vacation.

Buzzfeed offers a list of the 31 best destinations for road trips on a budget, including quaint and artsy Nashville, Indiana, viewing lighthouses in Maine, and public art installations off Route 66.

Pick fruit

Want a great way to support local farmers, get some fresh air and sunshine, and ensure you’re getting beautiful produce? Spend time visiting fruit farms and picking your own. Many farms have fields dedicated to self-picking, and you typically pay the same or almost the same as you would in the grocery store.

What’s more, spending time in nature is shown to provide numerous health benefits, such as improved short-term memory, lowered stress levels, reduced inflammation, improved vision, better concentration, and reduced risk of an early death.

Potlucks

Invite friends and family members for supper and ask everyone to bring a dish to share. You could even invite your neighbours to get to know them better. Spend time playing games; inside you can play board games or cards, and if the weather is nice, take the party outside for some bean bag toss or croquet.

Become a foodie

Not sure what you could make for those potlucks?

Try taking a cooking class!

Many communities offer classes at local kitchen boutiques or colleges.Another idea is to check YouTube for instructional videos. Try a foreign cuisine or some foods you never ate before. You can even explore gourmet or ethnic grocery stores for palate-tempting delights.

Smart Money!

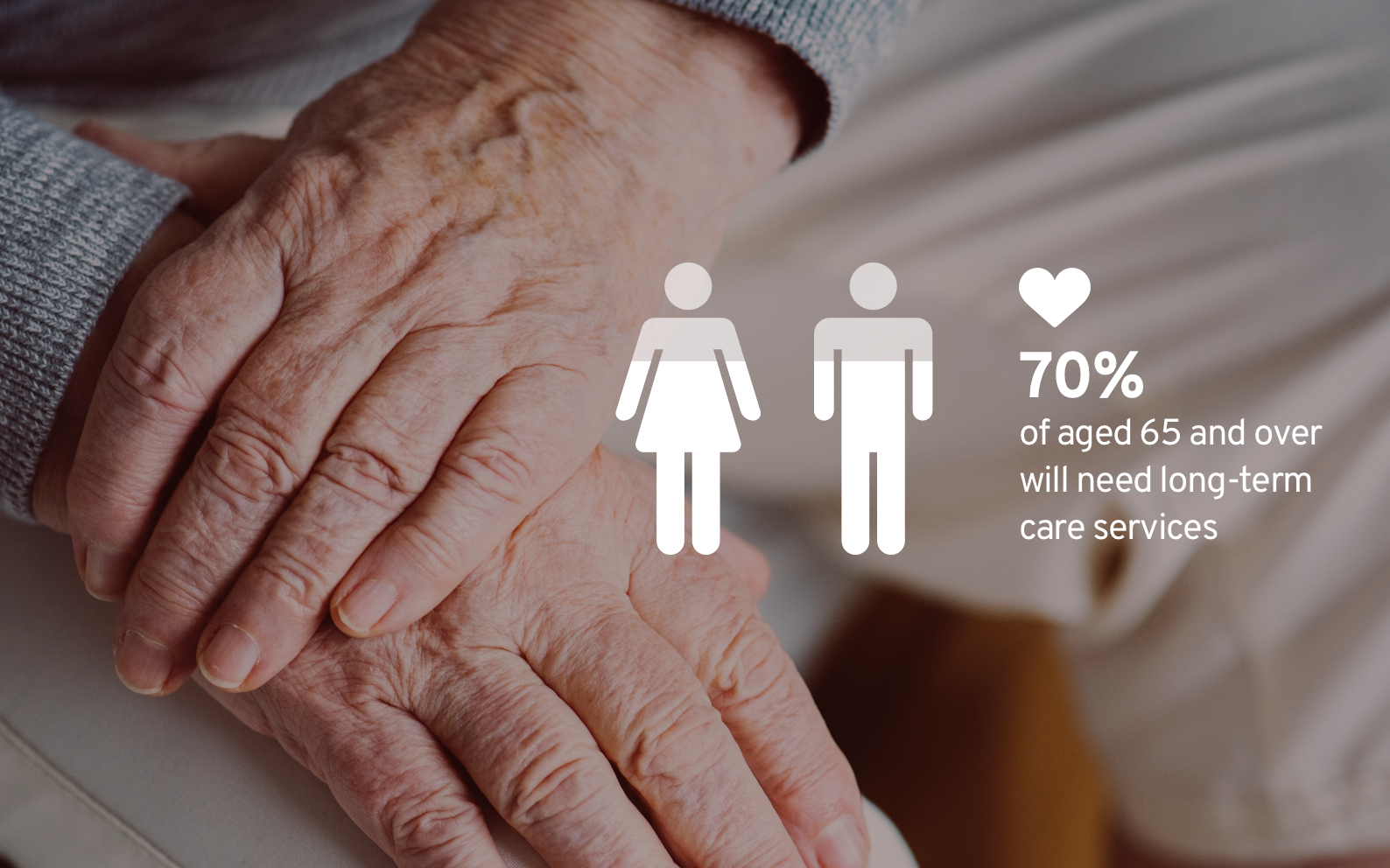

Of course, it’s not all about fun, so you want to make sure you’re still being realistic and prepared for the worst. After all, you want to enjoy your life but you know you aren’t getting younger. Everyday Health suggests investing in a few important documents if you haven’t already.

In the event you suffer a major health catastrophe, you should already have a plan in place.

Prepare your advance directives, including a living will, durable power of attorney, and other paperwork relating to your end-of-life wishes. It’s not the most fun to think about, but you’ll be surprised how much relief it provides to know you and your family members won’t need to make those decisions in the midst of a tragic occurrence.

Live Life Fully

Your senior years don’t need to be boring. Live a little! You can enjoy yourself and still make wise choices.

Spend your fun money — you earned it!

[adinserter block=”4″]