Israel-Hamas Stock Market War Effects

The ongoing Israel-Hamas war has raised concerns about its potential impact on financial markets, particularly the stock market. Geopolitical tensions and conflicts often influence investor sentiment and can lead to increased volatility in financial markets due to uncertainty. The current conflict between Israel and Hamas is no exception. Is there a Israel-Hamas stock? In this post, we will explore what stocks could benefit or get a hit because of the conflict.

How does the Israel-Hamas war impact the stock market?

Geopolitical tensions influencing stock market

The Israel-Hamas war has created significant geopolitical tensions, which are impacting investor sentiment. Geopolitical events have the potential to disrupt financial markets, as investors react to the uncertainty and assess the risks associated with the conflict. The stock market is no stranger to such volatility, and it is not uncommon to see fluctuations in stock prices during times of geopolitical turmoil.

Impact on stock market sensitive to geopolitical risks

Sectors sensitive to geopolitical risks, such as defense, energy, and transportation, are likely to be directly impacted by the Israel-Hamas conflict. Investors will closely monitor these sectors as they assess the potential implications of the war on their stock investments.

Conflicts in the Middle East and US Economies

Several Wall Street magnates have expressed concerns over the potential escalation of the conflict beyond Israel and Hamas. JPMorgan Chase’s CEO, Jamie Dimon, said that the current global situation might be the most perilous in recent decades due to the ongoing conflicts, including the Israel-Hamas war and the Ukraine crisis. He emphasized their possible profound effects on various sectors such as energy, food markets, global trade, and geopolitical ties.

Other experts highlighted historical precedents where conflicts in the Middle East significantly influenced US economies, leading to recessions and bear markets. Citing examples like the 1973 Yom Kippur War and the 1990 Iraqi invasion of Kuwait to illustrate the potential economic ramifications of the ongoing conflicts.

What is the effect of the Israel-Hamas war on oil prices?

Rising oil prices due to supply concerns

The Israel-Hamas war has raised concerns about the stability of oil supplies, particularly in the Middle East. As Israel and Hamas continue to engage in hostilities, there is a risk of disruptions in oil production and transportation routes. This uncertainty surrounding oil supplies can lead to higher oil prices in global markets as investors anticipate potential disruptions and adjust their trading positions accordingly.

Impact on transportation and energy-related stocks

Rising crude oil prices can have a significant impact on transportation and energy-related stocks. Increased fuel costs can erode profit margins for airlines, shipping companies, and other industries reliant on oil. As a result, investors may reduce their exposure to these stocks, leading to declines in their prices. Conversely, companies involved in oil production or alternative energy sources may benefit from higher oil prices and witness an uptick in their stock prices.

What is the effect on the stock market?

Global stock market reactions to the escalating tensions

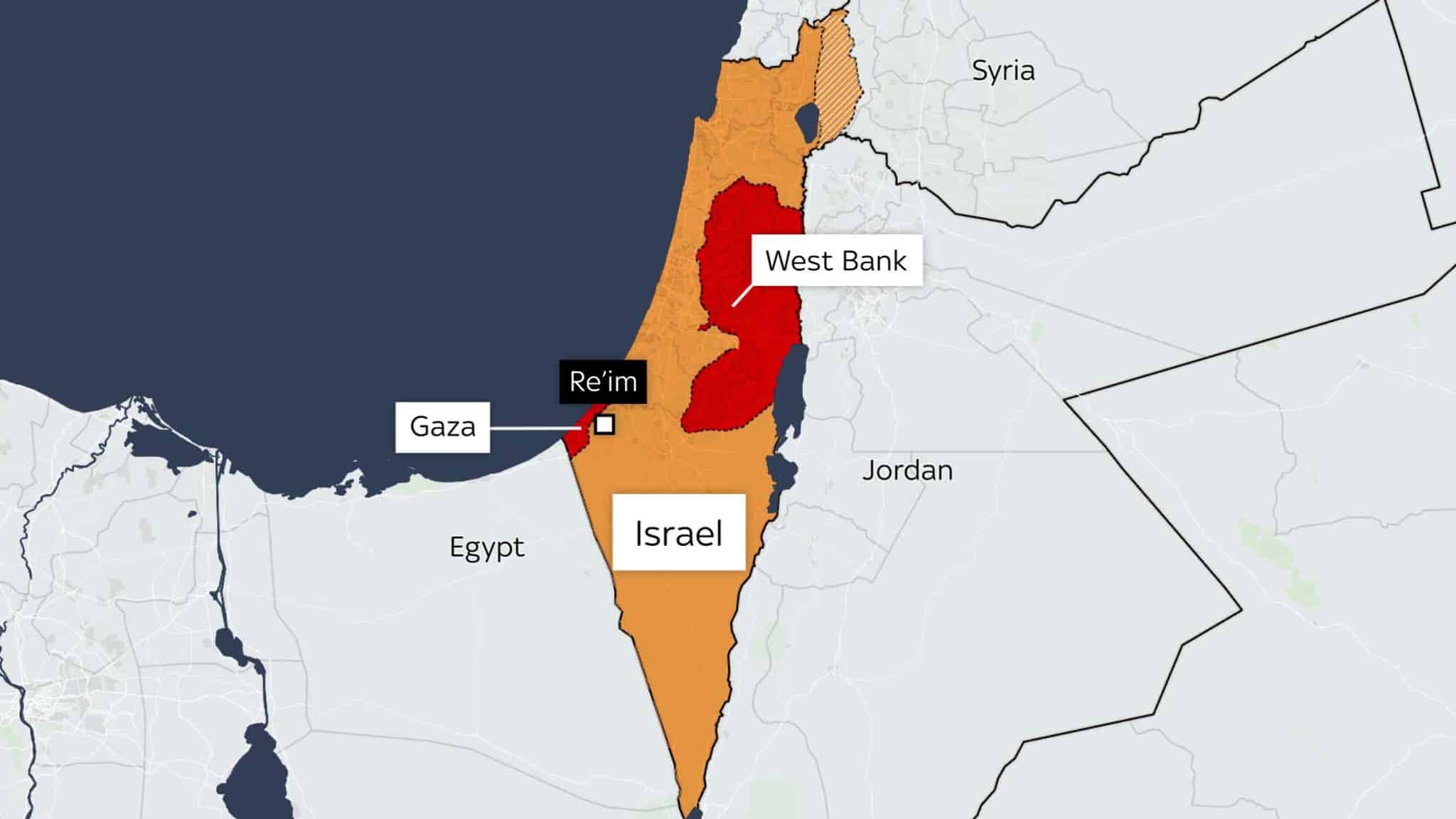

The conflict between Israel and Hamas has not been confined to the borders of the two nations. It has garnered global attention and has the potential to impact international markets. When geopolitical tensions escalate, international investors often react by repositioning their portfolios, leading to market fluctuations across the globe.

Therefore, it is likely that international markets will be influenced by the ongoing conflict.

Investor sentiment and risk aversion in different regions

The Israel-Hamas war can have varying impacts on investor sentiment and risk aversion in different regions. Investors in regions close to the conflict, such as the Middle East, may be more cautious and exhibit higher levels of risk aversion due to proximity and potential direct economic consequences. However, even investors in far-flung regions can be sensitive to geopolitical events, and their sentiment and risk appetite may be influenced by the conflict.

Impact on international trade and economic stability

The Israel-Hamas conflict can have a broader impact on international trade and economic stability. Disruptions to trade routes, increased political tensions, and uncertainty surrounding the outcome of the conflict can hinder global commerce and economic growth. Some countries heavily reliant on trade with the region may experience adverse effects on their economies, which could be reflected in their stock markets.

Is there a correlation between the war and stock market performance?

Historical evidence of market reactions during similar conflicts like Israel-Hamas

Historical evidence suggests that conflicts, particularly those with significant geopolitical implications, can have an impact on stock market performance. Past conflicts have shown that stock markets can experience initial declines in response to escalating tensions and uncertainties. However, market reactions are complex and can be influenced by various factors, including economic conditions, political developments, and investor sentiment.

Influence of news and media coverage on investor behavior

The Israel-Hamas conflict receives extensive news coverage, and media plays a crucial role in shaping investor behavior. News reports highlighting the potential ramifications of the war on financial markets can influence investor sentiment and prompt reactions in the stock market. The way in which the conflict is portrayed and analyzed by the media can impact the decisions and actions of investors.

What are the potential long-term effects of the Israel-Hamas war on the stock market?

Recovery and stabilization after the resolution of the conflict

Once the Israel-Hamas conflict reaches a resolution, the stock market has the potential to experience a recovery and stabilization period. The return of relative stability and reduced uncertainty can provide a favorable environment for investors to regain confidence and reenter the market. However, the duration and effectiveness of the resolution process will play a significant role in determining the speed and extent of the stock market’s recovery.

Impacts on specific industries and sectors in the aftermath

The aftermath of the Israel-Hamas war may have differing impacts on specific industries and sectors. Industries directly affected by the conflict, such as defense and energy, may experience long-lasting implications as governments reassess their defense strategies and energy markets adjust to new geopolitical dynamics. Investors will closely monitor these sectors for potential investment opportunities or risks.

Long-term implications for investor confidence and market growth

The Israel-Hamas war can have long-term implications for investor confidence and market growth. Persistent geopolitical tensions can erode investor trust and confidence in the stability of the region and global markets. Diminished investor confidence may hinder market growth and slow down economic recovery. Therefore, it is crucial to closely monitor the long-term effects of the conflict on investor sentiment and market performance.

Conclusion

Conflicts such as the ones involving Israel-Hamas can potentially impact the stock market. Stock markets are influenced by a variety of factors, including geopolitical events. When there is a significant conflict or war in a region, it can create uncertainty and instability in financial markets, leading to increased volatility.

Investors often react to geopolitical tensions by selling off stocks and seeking safer investments, such as bonds or gold. This selling pressure can lead to a decline in stock prices. Additionally, industries and companies directly affected by the conflict, such as those based in the region or involved in defense and security, may experience more significant market fluctuations.

It’s important to note that the extent of the impact on the stock market can vary depending on the scale and duration of the conflict, as well as other global economic and political factors at play.