Managing Money Smarter: The Top Personal Finance Softwares & Resources

Managing your personal finances effectively is essential for achieving financial stability and growth. With the advent of numerous personal finance software and apps, we now have a plethora of tools at our disposal to streamline money management. These software are designed to provide users with features such as budgeting tools, mobile app usability, integration with financial accounts, and reporting and analysis capabilities

Our Top Personal Finance Software guide is designed to empower individuals in their financial journey. In an age where financial literacy is crucial, this guide serves as an invaluable resource, offering insights into the most effective personal finance software and tools available.

From budgeting basics to advanced investment strategies, this post covers a wide array of topics, ensuring that readers, regardless of their financial knowledge level, find practical and applicable advice. It provides an in-depth look at various software solutions, each with unique features tailored to different financial goals and lifestyles. Whether you’re a frugal college student, a family planner, or a retiree looking to manage your savings more effectively, this guide has something for everyone.

With a focus on modern, tech-savvy solutions, the Top Personal Finance Software posts emphasizes the importance of staying informed and adaptable in an ever-evolving financial landscape. It is more than just a post; it’s a toolkit for financial independence and savvy money management in the digital age.

The Importance of Personal Finance Management

Personal finance management is crucial for several reasons:

- Budget Control: Effective management of personal finances allows individuals to keep track of their income and expenditures. This budgeting helps in avoiding overspending and ensures that expenses align with personal financial goals.

- Debt Management: Proper financial planning helps in managing debts more effectively. It enables individuals to prioritize debt payments, potentially reducing the interest paid over time and avoiding the trap of accumulating unmanageable debt.

- Tracking Savings and Investments: By managing finances efficiently, individuals can allocate funds towards savings and investments. This can lead to wealth accumulation and financial security in the long term, providing a cushion for unforeseen circumstances.

- Retirement Planning: Consistent and strategic financial management is key to planning for retirement. By saving and investing wisely, individuals can ensure a stable and comfortable lifestyle post-retirement.

- Emergency Funds: Personal finance management involves setting aside money for emergencies. This emergency fund acts as a financial safety net in case of unexpected events like medical emergencies or job loss.

- Financial Independence: Effective management of finances can lead to financial independence, where an individual is not reliant on a single source of income and has the freedom to make life choices without financial constraints.

- Informed Financial Decisions: With a good grasp of personal finance, individuals can make more informed decisions regarding investments, loans, and savings, leading to better financial outcomes.

- Stress Reduction: Financial uncertainties can lead to stress and anxiety. Effective finance management reduces this stress by providing a clear picture of one’s financial situation and a roadmap for the future.

- Wealth Building: Over time, efficient finance management can lead to wealth building, allowing individuals to achieve their long-term financial goals, whether that’s buying a house, funding education, or other personal aspirations.

- Legacy Planning: Good financial management includes planning for what will happen to an individual’s assets after their lifetime. This ensures that their legacy is passed on according to their wishes and provides for their loved ones.

Why use Personal Finance Softwares?

Using personal finance software offers several benefits in managing one’s finances:

- Automated Tracking and Analysis: Personal finance software can automatically track and categorize transactions from connected bank accounts, credit cards, and other financial accounts. This automation saves time and reduces the likelihood of errors in manual entry.

- Budgeting Tools: These software often come with budgeting tools that help users set spending limits and track their adherence to these budgets. This can be instrumental in developing and maintaining good spending habits.

- Debt Management: Many personal finance software applications provide tools to help users plan and track their debt repayment strategies, such as prioritizing high-interest debts.

- Investment Tracking: Some software includes features for tracking investments, monitoring portfolio performance, and even providing investment advice, which is useful for individuals looking to grow their wealth through various asset classes.

- Financial Goal Setting: Users can set financial goals, such as saving for a down payment on a house or funding a child’s education, and track their progress towards these goals within the software.

- Reporting and Insights: Personal finance software often generates reports and insights that can help users understand their financial habits and identify areas for improvement.

- Security: These software solutions typically offer robust security features to protect sensitive financial data, which is crucial in the digital age where data breaches are a real threat.

- Accessibility and Convenience: With cloud-based or mobile app options, users can access their financial information anytime, anywhere, making it easier to make informed financial decisions on the go.

- Tax Preparation: Some personal finance software can assist with tax preparation, tracking deductible expenses throughout the year and integrating with tax filing software.

- Historical Data Analysis: Over time, these tools can accumulate a wealth of historical financial data, allowing users to analyze trends and make more informed decisions about their future financial planning.

The Evolution of Personal Finance Management

The evolution of personal finance management and personal finance software reflects broader changes in technology, economy, and social attitudes towards money. In the early days, personal finance was largely a manual process. Individuals and families would use physical ledgers and checkbooks to track their income and expenses. This method required diligence and a good understanding of basic accounting principles. Budgeting was often done using pen and paper, and saving money was a concept taught within families or learned through personal experience.

As the banking industry evolved, so did the tools for personal finance management. The introduction of credit cards and bank statements helped people track their spending more easily, though it was still largely a manual process. This era also saw the emergence of financial advisors and planners who offered personalized advice, usually to wealthier clients.

The real transformation in personal finance management began with the advent of personal computers and the internet. Software like Quicken and Microsoft Money brought financial management into the digital age, allowing users to track their finances more efficiently and accurately. These programs automated many of the tedious aspects of personal finance, like categorizing expenses and tracking account balances.

With the turn of the millennium, online banking became more prevalent. This allowed individuals to manage their finances in real-time, check balances, pay bills, and transfer money with just a few clicks. The convenience and efficiency of online banking marked a significant shift in how people interacted with their financial institutions.

The smartphone revolution took personal finance management to another level. Mobile apps made it possible to manage finances on the go. These apps could do everything from tracking daily expenses to providing investment advice. The integration of artificial intelligence and machine learning in these apps further personalized financial advice, making it accessible to a broader audience.

Today, personal finance management is a blend of technology and personal touch. Robo-advisors offer automated investment advice based on algorithms, while human advisors provide the personal touch for more complex financial planning. The focus has shifted from mere tracking and managing of finances to achieving financial wellness and literacy. This shift is reflected in the growing emphasis on educational resources within personal finance apps and platforms.

The future of personal finance management seems poised to incorporate even more technology, with developments like blockchain and cryptocurrencies offering new ways to think about and manage money. Despite these technological advancements, the core principles of personal finance management remain consistent: understanding your income and expenses, saving and investing wisely, and planning for the future.

Different Types of Personal Finance Softwares

Budgeting Apps and Expense Tracking

Budgeting applications or budget apps, serve as a digital tool to manage your finances. It offers features like tracking expenditures, suggesting savings strategies, and providing insights into your spending habits. These applications often come with varied pricing models: some are entirely free, others charge a fee, and many operate on a ‘freemium’ model, where basic services are free but more advanced features require payment. By linking with your bank accounts and credit cards, these apps provide a comprehensive view of your income, expenses, and overall financial health.

If you are interested specifically in budget apps, or you came here looking for Mint Alternatives, our Top Budgeting Apps post might be of interest for you:

Mint Alternatives Round-Up; 8 Top Budgeting Apps to Balance Your Bucks Brilliantly

For those seeking alternatives to Mint for personal finance management, exploring Wealthica is a worthwhile consideration. While Mint is renowned for its budgeting and transaction tracking capabilities, offering an all-encompassing view of finances including bank accounts, credit cards, and loans, Wealthica shifts the focus towards investment tracking and portfolio management. Mint vs Wealthica might be a good place to start to compare both tools.

Additionally, Wealthica’s Mint Export & Import Data feature is particularly useful for transitioning from Mint, allowing users to seamlessly transfer their financial data and maintain continuity in their personal finance management journey.

Net Worth Tracking Apps

Net worth tracking apps have become a vital tool in modern personal finance management, offering users an integrated and comprehensive view of their financial health. These apps work by aggregating data from various sources, including bank accounts, investment portfolios, real estate holdings, and debts, such as loans and credit card balances. Users gain a clear, real-time picture of their overall financial status by visualizing their total assets minus their liabilities, which equals their net worth. This insight is crucial for long-term financial planning and goal setting.

Additionally, these apps often come with features like trend analysis, allowing users to track their financial progress over time and make informed decisions based on historical data. The convenience and intuitive design of these apps make them accessible to a wide range of users, from those just beginning their financial journey to seasoned investors looking to maintain a comprehensive overview of their financial landscape.

Personal Capital (now Empower) has established itself as a pioneer in the net worth tracking space, offering users comprehensive tools to monitor and manage their wealth. However, a significant limitation is its availability, as Personal Capital is not accessible to users in Canada. This has led Canadian users to seek Personal Capital Canada Alternatives that provide similar functionalities.

Among these, Wealthica has emerged as a highly acclaimed Personal Capital Alternative for Canadians. It caters specifically to the needs of Canadian investors and finance enthusiasts, offering robust features for tracking investments, net worth, and financial growth. Wealthica’s platform adapts well to the Canadian financial landscape, making it a go-to choice for those who require a tool akin to Personal Capital but with regional availability and relevance.

Investment Monitoring and Stock Tracking Apps

Investment monitoring and stock tracking apps have revolutionized the way individual investors interact with the stock market and manage their portfolios. These apps provide real-time data on stock performance, market trends, and global financial news, enabling users to make timely and informed investment decisions. They often feature customizable watchlists, detailed stock analysis, and interactive charts, making it easier for both novice and experienced investors to track the performance of individual stocks, mutual funds, and other investment vehicles.

Additionally, many of these apps offer educational resources and simulation tools for practice trading, which are particularly beneficial for those new to investing. The integration of trading features in some apps also allows users to buy and sell stocks directly from their devices, offering a seamless and convenient investment experience. The accessibility and depth of information provided by these apps have democratized investment knowledge, making the stock market more accessible to a broader audience.

Debt Management Apps

Debt management apps have emerged as a crucial tool for individuals looking to navigate and overcome the challenges of debt. These apps typically focus on helping users organize and manage various forms of debt, such as credit card balances, student loans, mortgages, and personal loans. They provide a consolidated view of all outstanding debts, often categorizing them by interest rate, balance, and payment due dates. Key features include customizable repayment plans, which can be tailored to prioritize debts (like focusing on high-interest debts first), and progress tracking, allowing users to visually monitor their journey towards being debt-free.

Many of these apps also offer notification reminders for upcoming payments, thus helping avoid late fees and maintain a good credit score. Some even integrate educational content on debt management strategies and financial wellness. By simplifying and demystifying the process of debt repayment, these apps empower users to take control of their financial situation, providing both a practical tool and psychological encouragement in the pursuit of financial stability.

Stock Recommendations or Opinions Apps (Buy, Sell or Hold?)

Stock recommendations or opinions, commonly termed as “Buy,” “Sell,” or “Hold,” are advisories provided by financial analysts or investment advisors regarding the future performance of specific stocks in the stock market. It’s basically what we do here at Stockchase. We report on stock recommendations that analyst report on finance web sites.

These recommendations are based on extensive research, including analysis of the company’s financials, market trends, industry conditions, and other economic indicators. However, it’s important to note that these are predictions and not certainties, and they should be considered as part of a broader investment strategy. The reliability of these recommendations can vary based on the analyst’s expertise, the quality of the research, and market volatility.

Financial Planning Apps

Financial planning apps have become a pivotal component in personal financial management, offering a user-friendly and integrated approach to managing various financial aspects. These apps assist users in creating comprehensive financial plans, encompassing budgeting, savings, investments, and retirement planning. They often provide tools for setting and tracking financial goals, whether it’s saving for a vacation, buying a home, or preparing for retirement.

Many financial planning apps also include features for monitoring daily expenses and income, thereby helping users maintain a balanced budget. Some advanced apps even offer personalized financial advice based on the user’s unique financial situation and goals.

Additionally, these apps can sync with bank accounts and investment portfolios, providing a real-time, holistic view of one’s financial health. This all-in-one convenience, combined with features like automated alerts for bill payments and savings milestones, makes financial planning apps a valuable resource for individuals looking to take control of their financial future.

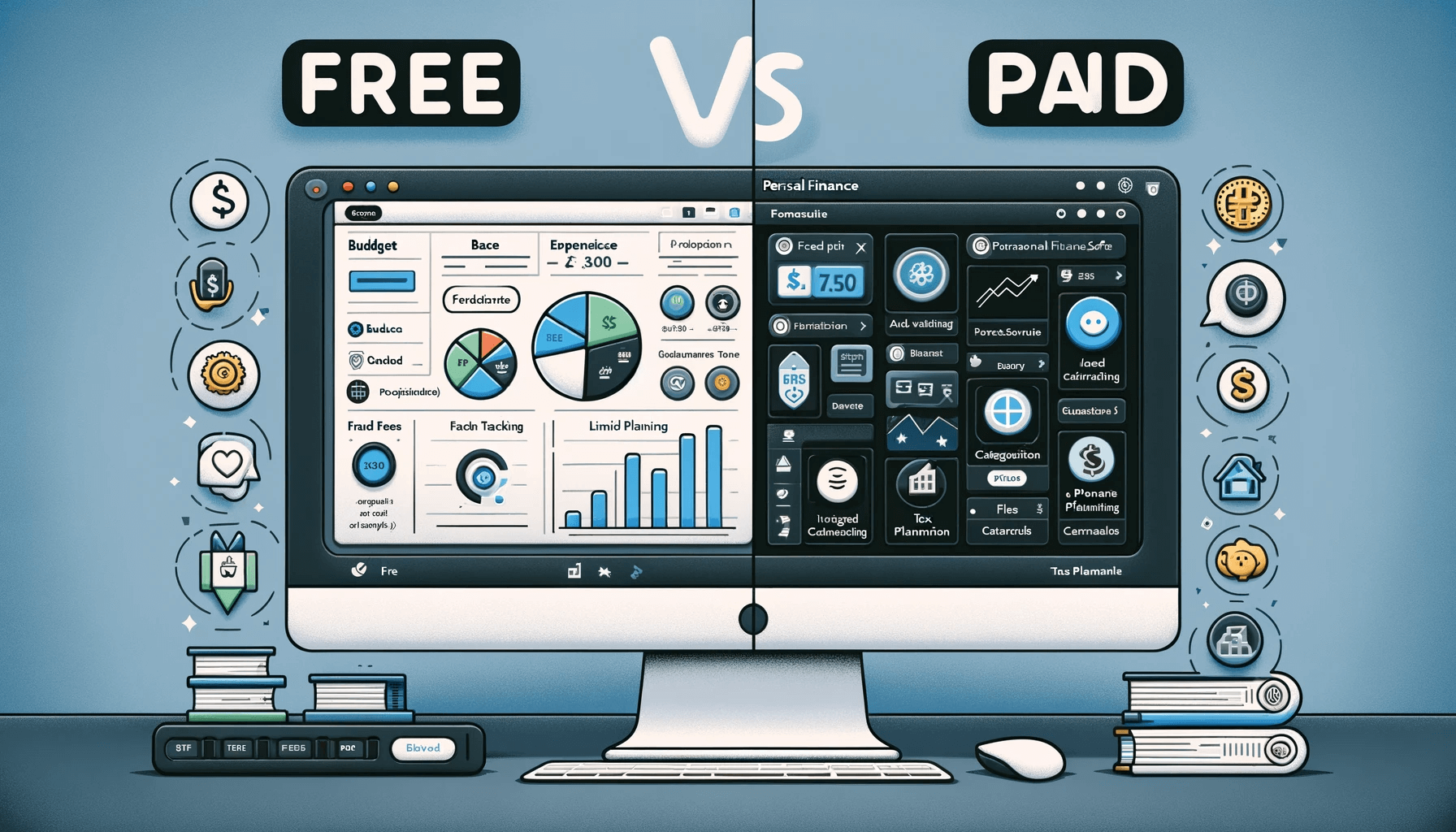

Free vs. Paid Personal Finance Software: Is It Worth Paying?

The decision to use free or paid personal finance software depends on individual needs, financial goals, and the complexity of one’s financial situation. Here’s a breakdown of key considerations:

Free Personal Finance Software: Pros and Cons

Pros:

- No Cost: The most obvious advantage is that it’s free, making it accessible for everyone, especially those starting on their financial journey.

- Basic Functionality: Free software often includes basic features like budget tracking, expense categorization, and sometimes investment tracking.

- User-Friendly: They are typically user-friendly, designed for the general public without requiring advanced financial knowledge.

Cons:

- Limited Features: The functionalities are usually basic. Advanced features like detailed investment analysis, tax planning tools, or retirement planning might be missing.

- Ads and Upsells: Free versions may include ads or constant prompts to upgrade to a paid version.

- Less Customization: There might be limited options for customization and integration with other financial tools or accounts.

Paid Personal Finance Software: Pros and Cons

Pros:

- Advanced Features: Paid versions often offer comprehensive features like detailed investment tracking, tax optimization strategies, and more sophisticated budgeting tools.

- Higher Security Standards: They might offer better security features, which is crucial for handling sensitive financial data.

- Customer Support: Access to customer support, including help with setup, troubleshooting, and advice on how to use the software effectively.

Cons:

- Cost: The most significant disadvantage is the ongoing cost, which can be a hurdle for some users.

- Complexity: These tools can be more complex, potentially overwhelming for users who need only basic functionalities.

- Commitment: Paying for software might feel like a commitment, making users less likely to switch platforms if their needs change.

Is It Worth Paying?

- Personal Needs: If your financial situation is complex, involving investments, rental properties, or self-employment, a paid tool might be more beneficial.

- Security and Privacy: Consider the importance of security and privacy in your financial transactions. Paid software might offer more robust security features.

- Long-Term Financial Goals: For long-term financial planning, including retirement or tax strategies, paid software might provide more comprehensive tools.

- Ease of Use: If ease of use and customer support are important, paid software often offers better support and user experience.

- Cost-Benefit Analysis: Consider the cost relative to the benefits. If the software saves you money, time, or helps significantly in decision-making, it might be worth the investment.

In summary, whether it’s worth paying for personal finance software depends on the individual’s financial needs and goals. Free software is suitable for basic budgeting and tracking, while paid software is better for more complex financial planning and analysis.

Emerging Trends: AI & Personal Finance Softwares

Personal finance software is a tool that helps individuals manage their finances effectively. It allows users to track their income and expenses, create budgets, and manage investments and debt. With the increasing complexity of personal finances, it has become essential for individuals to have a clear understanding of their financial health and make informed decisions about their money.

Managing personal finances can be a daunting task, especially with the numerous financial transactions that occur on a daily basis. Personal finance software simplifies this process by providing users with a centralized platform to track and analyze their financial data. It allows users to categorize their expenses, set financial goals, and monitor their progress towards achieving them.

Benefits of Using Personal Finance Software

1. Helps in tracking expenses and income: One of the primary benefits of using personal finance software is that it helps in tracking expenses and income. It allows users to categorize their expenses and income, making it easier to identify areas where they can cut back on spending or increase their income. By having a clear picture of where their money is going, individuals can make more informed decisions about their spending habits.

2. Provides a clear picture of financial health: Personal finance software provides users with a clear picture of their financial health. It allows them to see how much money they have coming in, how much they are spending, and how much they are saving. This information is crucial for making informed decisions about budgeting, saving, and investing.

3. Helps in creating and sticking to a budget: Personal finance software makes it easier to create and stick to a budget. It allows users to set financial goals and track their progress towards achieving them. By having a clear understanding of their income and expenses, individuals can allocate their money more effectively and avoid overspending.

4. Helps in managing debt and investments: Personal finance software also helps in managing debt and investments. It allows users to track their debts, such as credit card balances and loans, and create a plan to pay them off. It also provides tools for managing investments, such as tracking the performance of stocks and mutual funds.

5. Saves time and effort: Personal finance software saves time and effort by automating many of the tasks involved in managing finances. It eliminates the need for manual data entry and calculations, making it easier to stay organized and up-to-date with financial transactions.

Factors to Consider When Choosing Personal Finance Software

When choosing personal finance software, there are several factors to consider:

1. Compatibility with devices and operating systems: It is important to choose software that is compatible with the devices and operating systems you use. This ensures that you can access your financial data from anywhere and at any time.

2. Features and functionalities: Different personal finance software offers different features and functionalities. It is important to choose software that meets your specific needs. For example, if you are primarily interested in budgeting, look for software that offers robust budgeting tools.

3. User interface and ease of use: Personal finance software should have a user-friendly interface that is easy to navigate. It should be intuitive and require minimal training to use effectively.

4. Security and privacy: Since personal finance software deals with sensitive financial information, it is important to choose software that prioritizes security and privacy. Look for software that uses encryption technology to protect your data.

5. Cost and pricing plans: Personal finance software comes with different pricing plans, ranging from free to paid subscriptions. Consider your budget and the features you need when choosing a pricing plan.

The Top Personal Finance Software for Canadians

There are several personal finance software options available for Canadians. We invite you to read Mint Alternatives Round-Up; 8 Top Budgeting Apps to Balance Your Buck Brilliantly to discover some of the Top Budgeting Apps Canada.

Conclusion and Final Thoughts on Personal Finance Software for Canadians

In conclusion, personal finance software is a valuable tool for managing finances effectively. It helps in tracking expenses and income, provides a clear picture of financial health, helps in creating and sticking to a budget, helps in managing debt and investments, and saves time and effort.

When choosing personal finance software, it is important to consider factors such as compatibility with devices and operating systems, features and functionalities, user interface and ease of use, security and privacy, and cost and pricing plans.

Overall, personal finance software can greatly simplify the process of managing finances and help individuals make more informed decisions about their money. It is a valuable tool for anyone looking to take control of their financial health and achieve their financial goals.

Frequently Asked Questions

Q: Are Personal Finance Apps Safe?

A: Personal finance apps, while offering convenience and innovative features, carry a certain level of risk, much like any internet-based service. Their safety largely depends on the security measures implemented by the app developers. Most reputable apps use industry-standard encryption to protect user data, and some even employ advanced security protocols like two-factor authentication. However, users should remain vigilant. Risks can arise from weak user passwords, phishing scams, or data breaches at the company.

Regularly updating passwords, enabling additional security features, and researching the app’s privacy policy and security track record can mitigate these risks. Users should also be cautious about granting extensive permissions or sharing sensitive information unless absolutely necessary. While no online service is entirely risk-free, staying informed and cautious can significantly enhance the safety of using personal finance apps.

Q:How is Personal Finance important?

A: Personal finance is crucial because it equips individuals with the knowledge and skills to manage their money effectively, ensuring financial stability and security. Through personal finance, individuals learn to budget, save, invest, and manage debt, which are essential for achieving short and long-term financial goals, such as purchasing a home, funding education, or securing a comfortable retirement.

It also fosters financial literacy, empowering people to make informed decisions and avoid pitfalls like excessive debt, financial scams, or poor investment choices. Moreover, effective personal finance management can lead to a better quality of life, reduced stress related to financial uncertainties, and the ability to handle unexpected expenses or economic downturns.

In essence, personal finance is not just about money management; it’s about making strategic decisions that shape one’s financial future and overall well-being.

Q: What Does Personal Finance Means?

A: Personal finance refers to the management of financial activities and decision-making of an individual or household, encompassing a broad range of aspects including earning, saving, investing, and spending. It involves setting financial goals and creating strategies to achieve them, which may include budgeting, planning for retirement, managing debt, and investing in stocks, real estate, or other assets.

Personal finance is not just about the mechanics of handling money; it’s also deeply intertwined with understanding the principles of financial literacy, such as the importance of saving, the impact of interest rates, and the risks and rewards of different types of investments.

Essentially, personal finance is the art of balancing one’s financial resources to maximize financial security and well-being, both now and in the future. By mastering personal finance, individuals gain the power to shape their financial destiny, ensuring they can meet life’s challenges and opportunities with confidence.

Q: How Do Personal Finance Apps Work?

A: Personal finance apps are designed to simplify and enhance the management of one’s financial life. They work by aggregating and analyzing data from various financial sources such as bank accounts, credit cards, investments, and loans. Users typically start by securely linking their financial accounts to the app, which then automatically tracks and categorizes transactions. This allows for a comprehensive view of income, expenses, savings, and investment portfolios, often presented in user-friendly dashboards and reports.

Many personal finance apps also offer budgeting tools, enabling users to set spending limits, track progress, and receive alerts when they’re nearing their budget caps. Some apps go further by offering features like bill reminders, investment tracking, and even personalized financial advice based on the user’s spending patterns and financial goals.

Additionally, advancements in technology have enabled these apps to incorporate features like artificial intelligence and machine learning to provide more accurate and predictive financial insights, making personal finance management not just more efficient but also more intelligent.

Q: What Are Good Personal Finance Apps Canada?

A: In Canada, several personal finance apps stand out for their robust features and reliability, catering to a range of financial management needs. Wealthica, renowned for its user-friendly interface, offers comprehensive net worth tracking tools and stock tracking, making it ideal for everyday money management. For those focused on investments, Wealthsimple provides an accessible platform for automated investing and personalized portfolios, along with a high-interest savings account. PocketGuard is another popular choice, particularly for those looking to simplify budgeting and control overspending by linking all financial accounts in one place. Each of these apps caters to different aspects of personal finance, from budgeting and saving to investing, offering Canadians tailored solutions for better financial management.