3 Canadian Stock Ideas by Chris White, CFA

This post was prepared for Stockchase by Chris White, CFA at 5i Research.

At 5i Research we cover many Canadian companies across different sectors and industries, and we feel that right now there are several names that are presenting good long-term opportunities. With an improving economic backdrop and a pause in Canadian interest rates, we feel that this is a good time to be shopping for new stock ideas, and in this article we want to focus on three Canadian names that we feel can grow their fundamentals, remain resilient, and provide stable, recurring cash flows.

Dollarama (DOL)

Dollarama is a Canadian-based company that operates discount retail stores across the country. It sells everyday consumer products at a discount, and is conveniently located in metropolitan areas, midsize cities and small towns. What we like most about Dollarama’s business model is its resilience across the business cycles – in good economic times, DOL is benefiting from increased consumer spending and consumer confidence, and in recessionary environments DOL is seen as a defensive name due to its low and relatively stable prices.

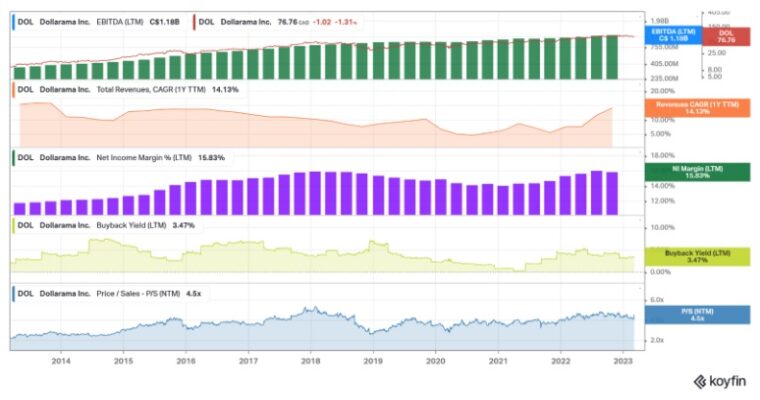

In the graphs below, we can see that DOL has demonstrated its robust fundamentals through its consistent EBITDA growth, strong revenue growth, and recent net profit margin expansion. The company also sports a solid buyback yield of ~3.5%, using its free cash flows to provide shareholder value. Its price to sales multiple has fluctuated over the years, albeit within a fairly consistent range that we feel is appropriate for the stock. Overall, this is a resilient name that has grown its fundamentals through both the good and bad times.

FirstService Corporation (FSV)

FirstService Corporation is a North American leader in the property services sector serving customers through two industry segments: FirstService Residential and FirstService Brands. FirstService Residential is the largest provider of residential property management services in Canada, while FirstService Brands is a leading provider of essential property services such as restoration and painters for residential and commercial customers. What draws us towards FSV’s business model is its highly predictable, recurring cash flow profile, and strong returns on capital. The company has a strong balance sheet and is well-capitalized for future organic and inorganic growth initiatives. FSV has a strong presence across North America and it continues to grow its client coverage footprint through its acquisitive nature.

We measure FSV’s fundamental strength through its EBITDA expansion, EBITDA margins, and revenue growth. We can see a steady increase in the company’s EBITDA over the past several years, alongside a healthy price performance in that same timeframe (red line). The company’s EBITDA margins have been negatively impacted over the past year as economic activity and confidence declined, however, we have begun to see encouraging signs of this margin and revenue growth turning around. The recent improvement in financials has caused the stock price to begin recovering from its 2022 lows and its forward price to sales ratio is nearing its pre-pandemic levels. We like the direction that FSV is heading in and feel that it can continue to perform well through its organic and inorganic quest for growth.

Trisura Group (TSU)

Trisura Group is an international specialty lines insurance carrier that has operations in surety, risk solutions, corporate insurance, fronting, and reinsurance. The company’s Canadian specialty lines insurance and reinsurance businesses were founded and created with Brookfield Asset Management and were subsequently spun-off in 2017, at which time TSU became a public company. Specialty insurance is a specific type of insurance that most traditional property and casualty insurers will not write, and it is typically associated with higher premiums and higher claims severity. TSU is benefitting from its market share expansion within the US, and we feel that its surety business should see some tailwinds over the next few years. We like TSU’s business model as it has the ability to witness high growth rates in favourable insurance markets and due to its specialized nature. Management has done an excellent job of expanding its operations within the US and we like its prospects for continued market share growth across North America.

In the graphs below, Trisura’s financial success has been a combination of its historically strong revenue growth rates (hovering around 50% over the past couple of yeas), an expansion in its balance sheet, and a consistently strong free cash flow yield. On a valuation basis, TSU is at a fairly reasonable forward P/E of 17.1X, and its share price performance has reflected these healthy fundamentals. The company has a strong management team, and its high free cash flow yields combined with a steadily increasing equity position allow the company to pursue growth within the company or via acquisitions.

Strong Cash Flows and Consistency

These names have been dominated by trends of strong and recurring cash flows and consistency in revenue growth. We feel that these are names with potential for 2023 and beyond, and all have unique value propositions. We particularly like the diversification that these three names bring, and in an uncertain market, the historical resiliency of these names is critical.

At 5i Research, we write research reports on FirstService Corporation (FSV) and Trisura Group (TSU), and individuals can take a read through the reports using the free trial link below.

Try 5i for Free

You can try 5i Research for free with a 14-day trial by following this link and entering the code: wealthica2023