Trending stocks today

TSE:ZUB

25.81Related posts

Our Mega List of the Latest ETFs Mentioned on StockchaseThis week’s new 52-week lows… (Dec 12-18)This week’s new 52-week lows… (Dec 05-11)BMO EQL WGT US BANK HDGD TO CAD IDX ETF(ZUB-T) Frequently Asked Questions

What is BMO EQL WGT US BANK HDGD TO CAD IDX ETF stock symbol?

BMO EQL WGT US BANK HDGD TO CAD IDX ETF is a Canadian stock, trading under the symbol ZUB-T on the Toronto Stock Exchange (ZUB-CT). It is usually referred to as TSX:ZUB or ZUB-T

Is BMO EQL WGT US BANK HDGD TO CAD IDX ETF a buy or a sell?

In the last year, there was no coverage of BMO EQL WGT US BANK HDGD TO CAD IDX ETF published on Stockchase.

Is BMO EQL WGT US BANK HDGD TO CAD IDX ETF a good investment or a top pick?

BMO EQL WGT US BANK HDGD TO CAD IDX ETF was recommended as a Top Pick by on . Read the latest stock experts ratings for BMO EQL WGT US BANK HDGD TO CAD IDX ETF.

Why is BMO EQL WGT US BANK HDGD TO CAD IDX ETF stock dropping?

Earnings reports or recent company news can cause the stock price to drop. Read stock experts’ recommendations for help on deciding if you should buy, sell or hold the stock.

Is BMO EQL WGT US BANK HDGD TO CAD IDX ETF worth watching?

0 stock analysts on Stockchase covered BMO EQL WGT US BANK HDGD TO CAD IDX ETF In the last year. It is a trending stock that is worth watching.

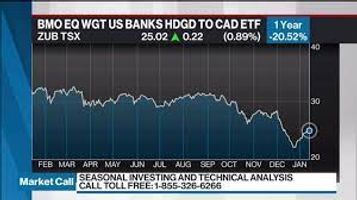

What is BMO EQL WGT US BANK HDGD TO CAD IDX ETF stock price?

On 2024-04-19, BMO EQL WGT US BANK HDGD TO CAD IDX ETF (ZUB-T) stock closed at a price of $25.81.